Despite high hopes for a roaring start to the New Year, the first half of 2025 in Venture Capital (VC) has been marked by caution and uncertainty. A confluence of macroeconomic and geopolitical headwinds – notably trade tariffs and regional conflicts – have weighed on investor sentiment.

Several anticipated IPOs have been put on hold due to tariff-related jitters and economic uncertainty, exacerbating an already tepid liquidity environment. Ironically, this comes even as public stock indices have rallied near record highs – a divergence that highlights the mismatch between buoyant, yet volatile, public markets and more lukewarm private markets.

The question becomes, what’s in store for Venture Capital in the second half of 2025?

Liquidity Crunch: IPOs Remain on Ice

The VC “exit” pipeline – IPOs and unicorn acquisitions – remained largely frozen through the first half of 2025. The stall in exits has been a top concern for venture investors because, without liquidity events, investors aren’t seeing capital returned.

CoreWeave’s successful IPO, momentum in VC-backed M&A activity, and Artificial Intelligence-related acquisitions are notable bright spots, but mask deeper challenges. In reality, just 12 VC-backed companies completed public listings in Q1 (one of the lowest tallies in years), and outside a handful of headline-grabbing deals, the overall exit market remained subdued with liquidity worries persisting.

Later-stage startups that, in a better market, would have gone public by now are stuck in limbo, unwilling to accept the valuation resets that public markets might impose. This backlog of aging unicorns – roughly 40% of U.S. unicorns have been in portfolios for nine years or more – is building pressure on VCs to find some path to deliver returns.

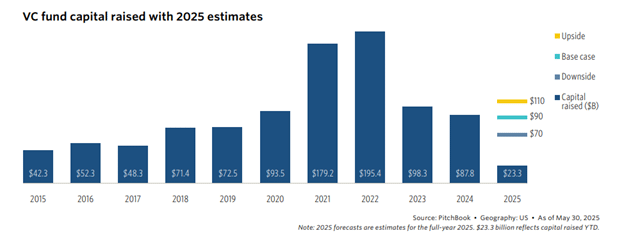

The knock-on effect of weak exits is a VC fundraising crunch. With private companies struggling to return capital, LPs have grown skittish about committing money to new funds. Aside from outliers like Peter Thiel’s Founders Fund, which bucked the trend by closing a $4.6 billion fund in April, PitchBook indicates that less than $25 billion has been raised by new VC funds so far in 2025.

The AI Investment Boom Amid a Cautious Climate

One big exception to Venture Capital’s malaise in 2025 can be summed up in two letters: AI. Artificial intelligence has become the magnet for the majority of venture dollars, creating a stark bifurcation in the startup ecosystem.

In the United States, roughly 71% of all VC deal value in Q1 went into AI-related investments, thanks largely to a single colossal transaction – OpenAI’s $40 billion funding round. Even excluding that outlier deal, nearly half of all venture capital invested in Q1 still flowed into AI startups.

This indicates an extraordinary concentration of capital into one sector. PitchBook’s analysts note that investor attention is overwhelmingly fixated on AI, leaving founders in other industries struggling to secure capital.

Some market observers worry that the frenzy around AI could be entering bubble territory, with valuations predicated on exuberant growth projections. Nevertheless, for now AI remains the undisputed center of gravity in the venture world. Entire sectors – from cloud computing to biotech – are being repositioned or pitched as “AI-powered” in hopes of capturing investor interest. PitchBook’s midyear report confirms that AI continues to dominate investor attention and even notes that other sectors like life sciences and clean technology are starting to piggyback on this momentum as VCs adjust their priorities.

Outlook for the Second Half of 2025

Looking ahead to the remainder of 2025, the challenges that defined the first half – from liquidity constraints to macro headwinds – are expected to persist in some form, but there are glimmers of improvement on the horizon.

Chief among them is a potential uptick in exit activity. There are signs that the IPO window may gradually reopen: a number of well-known tech companies have been quietly preparing filings, and PitchBook projects a moderate rise in large tech IPOs in late 2025 if market volatility stays in check – a big “if” at present.

Likewise, the environment for large acquisitions could improve. A change in U.S. administration policy has raised hopes for a loosening of M&A regulatory restrictions, which would make it easier for both corporate giants and big startups to pursue acquisitions without fear of antitrust roadblocks.

Additionally, mergers and acquisitions (M&A) have emerged as a relative bright spot – albeit in an unexpected way. With traditional exit routes like IPOs constrained, many VC-backed companies have turned to M&A as an alternate path to liquidity and growth.

Notably, venture-backed startups are not just targets in these deals; increasingly, they are the acquirers. In fact, recently over one-third of all acquisitions of VC-backed startups have involved another VC-backed company as the buyer, a record-high share of such transactions. This marks a fundamental shift from the past, when big tech companies or PE firms were the typical startup acquirers. Should this trend continue, investors will see an uptick in M&A as a hugely positive development because it will start to turn the flywheel again – delivering returns back to LPs and freeing up capital to reinvest in new opportunities.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.