For early-stage growth companies, capital is the lifeblood that enables a company to meet its product and commercial milestones. Meeting these milestones are essential for unlocking additional capital and continuing to fuel growth. While this capital can come from various sources, Venture Capital (VC) is the most common source for early-stage companies.

From a founder’s perspective, the fundraising process is almost always in motion – regardless of how recently a round was closed or how much cash is sitting on a company’s balance sheet. Depending on use of funds, growth rate, investor appetite, and market conditions, rounds can layer on top of each other fairly quickly. After all, the worst place to be for an early-stage company is cash strapped with limited runway to execute on growth ambitions.

Venture debt is one tool that early-stage companies have employed to extend runway, as performance insurance, and to fund acquisitions or capital expenses. As a rule, venture debt is complementary to equity; in other words, it doesn’t replace equity rounds, it follows.

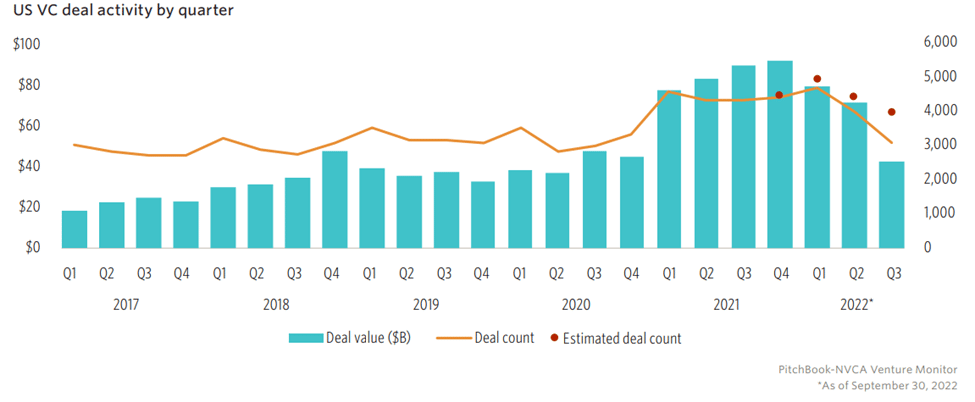

As show in the chart below, US startups borrowed $9.7 billion in venture debt in the second quarter of 2022, which was the second-highest quarter on record. However, in Q3, both deal value and activity dropped off a proverbial cliff as venture debt more-than-halved to $4.7 billion, the lowest quarterly volume since the third quarter of 2017.

The reason for this drop-off is two-fold: increased borrowing costs and fewer equity raises in Q3.

On the first point, the US Federal Reserve has continued to raise rates in its fight against inflation, increasing borrowing costs throughout the process. According to Pitchbook, “spreads on venture debt jumped on average 150 to 300 basis points for enterprise software and well above 300 basis points for ecommerce and consumer businesses.” This has made it more expensive for early-stage companies to borrow capital, dampening the appetite to pile venture debt on top of equity financings.

On the flipside, shareholders are acutely aware of dilution during equity financings, which continues to make venture debt an attractive option, despite increased borrowing costs. The level of venture debt available is based on the amount of equity a company has raised, with loan sizes varying between 25% and 50% of the amount raised in the most recent equity round. So, hypothetically, if a company needed to raise $20M, it could still make sense to raise a portion of the round in venture debt, balancing higher borrowing costs with a less dilutive round.

On the second point, venture-backed companies raised nearly $43 billion during Q3. While this is still above historical average, it is still well below the heights of 2021 and early 2022. Further, the number of deals, or deal count, also dipped.

As highlighted in Lessons From a16z, there is roughly $290 billion in “dry powder” sitting on the sidelines waiting to be deployed. As such, although dealmaking activity has slowed since 2021 and the start of 2022, the expectation is that equity financings will pick up steam moving into 2023. The question is whether venture debt will follow suit, or if higher borrowing costs will weaken demand even further in the eyes of entrepreneurs and their VC-backers.

Michael Johnston

Tech Contributor

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.