By Udith Sikand and Vincent Tsui

Does the pullback of the last few weeks ring time on the rally that lifted emerging market assets and currencies from October to January? Or does it present an attractive entry point for investors who may have missed the first stage of a protracted period of outperformance that promises to stretch through the rest of 2023?

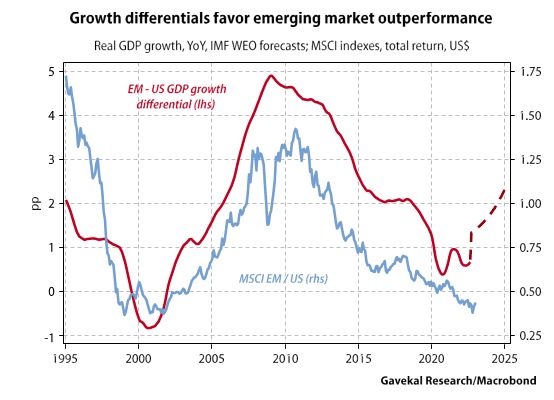

To determine the likely answer, it will help to weigh the forces that propelled the initial rally against those behind the pullback. Between late October and late January, the MSCI emerging markets index rose 25% in US dollar terms, handsomely outperforming the MSCI US index, which climbed just 4%. Behind this run-up were two principal forces: (i) hopes for a “pivot” away from policy tightening by the US Federal Reserve, which would lead to easier US dollar financial conditions and a softer US dollar against emerging market currencies; (ii) expectations that Beijing’s abandonment of strict Covid controls would lead to a vigorous rebound that would boost China’s demand for exports from other emerging markets.

As a result, investors poured money into emerging markets, with the Institute of International Finance estimating net portfolio inflows of more than US$65bn in January alone.

Since the end of January, however, hopes of an early halt to US rate rises have given way to expectations that the Fed will tighten further and be slower to cut. Meanwhile, investors have refined their view of the Chinese upturn, which is likely to be driven mainly by consumption and services, rather by surging investment like previous Chinese rebounds. In response, the US dollar has regained ground against emerging currencies, and the MSCI emerging markets index has given back -4.5%, pulled down a by -8.7% fall in the MSCI China index.

So, where does this leave us? Were earlier expectations of emerging market outperformance misplaced? Or do they still hold good, despite the pullback?

First, China. Policymakers are not ramping up stimulus on the scale of 2009 and 2016. But they are aiming to support the recovery, especially in the property sector. This implies support for global commodity demand, with a potential upside kicker for prices as increased Chinese oil demand puts upward pressure on global energy prices, and by extension on prices across the commodity complex.

Meanwhile, the return of Chinese spending on outbound tourism, which could rise by US$100bn in 2023, will disproportionately benefit emerging markets, especially in Asia.

Next, the US. There is intense debate—including within Gavekal—whether or not the US is heading into recession. A US recession would be negative for global final demand, which all else equal would weigh on emerging market growth through the trade channel. But all else is seldom equal, and the main influence of the US on emerging economies is not through trade but through the financial channel.

Here the big risk for emerging markets is that continued aggressive rate rises by an overly-hawkish Fed propel another sharp rally in the US dollar, further tightening financial conditions for emerging economies. However, with the Fed acknowledging that “a disinflationary process has started” few investors are looking for more than another 50bp of US rate hikes in the near term.

With the US dollar richly valued by historical standards, a halt to US rate hikes over the coming months implies a softening of the US dollar and easier financial conditions for emerging markets. This will allow emerging economies which were early to tighten policy—notably Brazil and Chile—to compound the beneficial effect with domestic rate cuts.

The balance of forces therefore is still likely to net out as positive for emerging market growth relative to developed markets. And historically, that has been bullish for emerging market assets. The pullback is a buying opportunity.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.