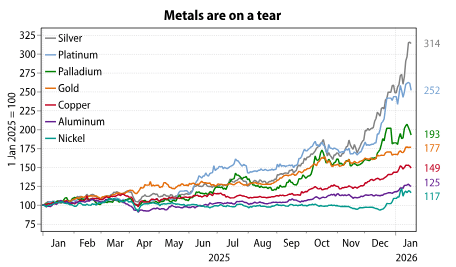

Precious metals have started 2026 as they finished 2025. Year to date, gold is up 8%, platinum 15%, and silver has gained an impressive 32%. Interestingly, industrial metals are also now joining the party. Copper has gained 4%, aluminum is up 5% and nickel is up 6%. This continuation of last year’s impressive performance leaves investors to ponder: what will stop this unfolding bull market?

When looking at any asset class, at Gavekal we like to go through a four-step process. We start with what we loosely call “fundamentals.” The idea is that there is no point in getting involved in assets that are structurally flawed, or possibly even condemned by the march of progress (horse buggies, sewing machines etc.). The second step is “momentum,’’ and the question of whether the market is on board with an asset’s rerating. The third step is “investor positioning.” Essentially, we try to ascertain whether an asset class has become too big as part of people’s portfolios. The final step is “valuations.” With all this in mind, how does the unfolding bull market in metals score?

Fundamentals. The oldest saying in commodity markets is that “just as low prices are the cure for low prices, so high prices are the cure for high prices.” Inherent in this statement is the reality that large changes in prices affect both supply and demand. Over the very long term, this is always true. But will this be true for metals over the coming quarters and years? The first obvious issue on the supply side is that for over a decade, miners have essentially been starved of capital. And given the lead time to bring a mine to market, it is not obvious that miners will be able to meaningfully expand production in any major metal over the coming years.

Worse still, with prices rising rapidly, various governments cannot seem to help themselves, and are either seizing mines outright (Mali, Burkina Faso) or are restricting supplies for domestic use (Indonesia). So by and large, it seems that the supply of most metals is likely to remain constrained.

Meanwhile, on the demand side of the ledger, it seems fairly obvious that policy settings and politics around the world—loose fiscal policies, loose monetary policies, growing geopolitical risks—continue to favor stockpiling commodities, whether for central banks, commodity consumers or individual investors. At the same time, the need to upgrade electricity grids means that the demand for copper and silver is likely to keep growing, along with demand for aluminum and nickel. In short, the fundamentals for metals appear bright.

Momentum. Obviously, the momentum is very strong (or there would be no need for this Daily!). Metals were the best-performing asset class of 2025, and seem eager to continue their run into the new year.

Investor positioning. This is a tricky one, because investor positioning diverges massively around the world. Across the Western world, investors seem to have broadly faded the sharp rise in metal prices over recent years. At least, this is what the numbers of shares outstanding in GLD.US (the biggest US gold ETF), SGLD.LN (the biggest European gold ETF) and GDX.US (the biggest gold-miner ETF) would seem to suggest. Amazingly, given the current backdrop, shares outstanding in GDX.US are hovering close to a 10-year low. Meanwhile, in Asia, the picture is the polar opposite. Shares outstanding in the biggest Chinese and Japanese gold ETFs keep on climbing, as does retail buying of the physical metals.

All of which harks back to a longstanding Gavekal belief: that precious metals do not hedge against inflation, so much as gold hedges against excessively low interest rates and currency debasement. In Asia, interest rates at the short end of the curves are too low for domestic savers, and currencies have been too weak. As a result, it has made sense to shift savings into zero-yield metals.

With this in mind, at least since October it has appeared that the biggest threat to the precious metals bull market would be a rise in Asian currencies. Since then, the renminbi has started to rise, but the Japanese yen took another leg down (precious-metals-bullish). So, the messaging has been very mixed here.

For now at least, Asian investors are still buying metals, while Western investors have not really started. This leaves two possibilities. The first is that Asian investors stop buying. For this to happen, they will likely need better domestic alternatives for capital deployment (higher currencies and roaring domestic equity bull markets). The second is that Western investors start to buy. But if that happens, who will be the seller?

Valuations. This is the dark spot in the unfolding bull market. By any historical standard, valuations, especially for precious metals, are now stretched. US wages have never been this low relative to gold. Neither have median US house prices. The oil-to-gold ratio and the oil-to-silver ratio are at extremes. So are the ratios of gold and silver to wheat. However, things are less extreme for platinum (which historically used to be more expensive than gold), copper, aluminum, nickel etc.

Having said all this, in a world awash with excess liquidity, and in which central banks seem comfortable with levels of inflation that are above previous norms, could it be the case that in recent years valuations have mattered less? Any money manager who sold US tech stocks and growth stocks as they became expensive quickly found himself out of a job. The same can be said for the US dollar (also expensive), just as anyone who bought oil (very cheap), emerging markets (attractively valued), or Chinese equities also struggled, at least until recently.

Conclusion. The fact that the rally in the renminbi over the past month has essentially been like water off a duck’s back to the metals bull market is probably an important signal. Arguably, a stronger renminbi should lead to a reallocation away from precious metals and towards a greater rally in industrial metals. So far, this has yet to really happen. Nonetheless, the continued outperformance of silver (more of an industrial metal) against gold (more of a precious metal) could be a signal that the industrial metals bull market still has room to run.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. The information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. The items included in this publication are our opinion as of the date of this piece, not all encompassing, and are subject to change without notice. Any tax or legal advice contained in this communication is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.