“I am worried about the systemic risks associated with these loans. There has been a huge deterioration in standards; covenants have been loosened in leveraged lending.”

–Former Fed chairman JANET YELLEN

How soon we forget. George Santayana long ago wrote these immortal words: “Those who cannot learn from the past are doomed to repeat it”. However, a more recent thinker took his observation one step further by wryly observing (with a little paraphrasing by yours truly): “And the rest of us are doomed to suffer along with them”.

In this week’s Guest EVA, I am once again running a condensed edition of my close friend Grant Williams’ immensely popular Things That Make You Go Hmmm. In this issue, Grant is taking dead aim at one of the biggest bubbles that has been encouraged allowed to re-inflate thanks to the infinite wisdom of our former Fed-heads: the housing market. It is truly astounding to me (and Grant concurs) that after what happened a mere decade ago we are right back at it—but I guess I need to re-read my Santayana.

It was several years ago that I heard Grant utter a brilliantly concise summary of the mind-set that has dominated for so many years. To wit: “The big bubble these days is in complacency.”

Admittedly, as has been the case with what I have often called the “Longest Bubble Ever” (much more on this in a future Bubble 3.0 EVA), said complacency has been in place for a very long time. Moreover, it’s been undeniably rewarding to its practitioners, at least until fairly recently. To defend that last point, JP Morgan Chase in a recent strategy paper noted that just 20% of global asset classes are generating positive returns this year, a number so low that it was only seen during the stagflationary 1970s and the depths of the Global Financial Crisis (a hat tip to my other great friend, Danielle DiMartino Booth, for this factoid).

Yet, incredibly, the pervasive complacency persists. This is despite headlines such as the one from a recent Seattle Times article on the hometown housing market:

Source: Seattle Times, 11/6/2018

Source: Seattle Times, 11/6/2018

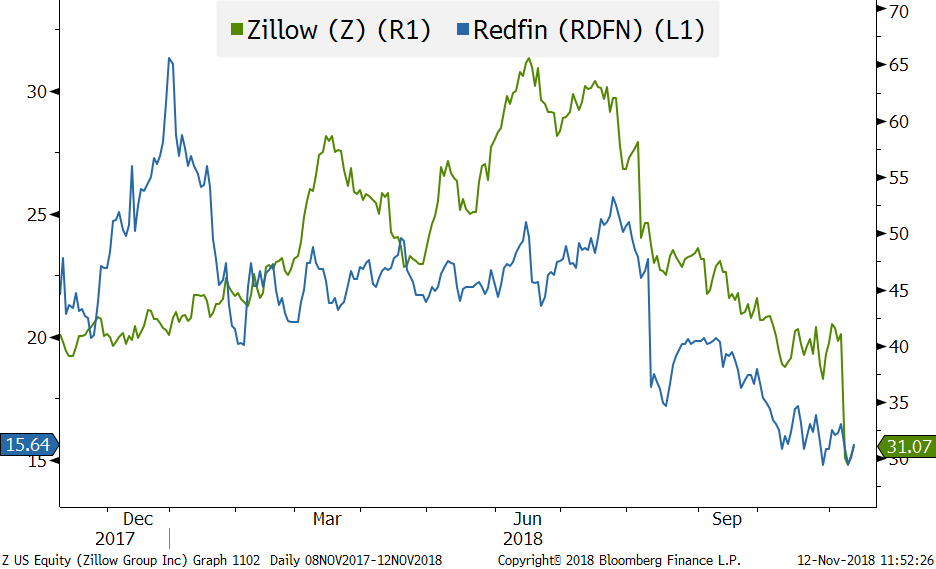

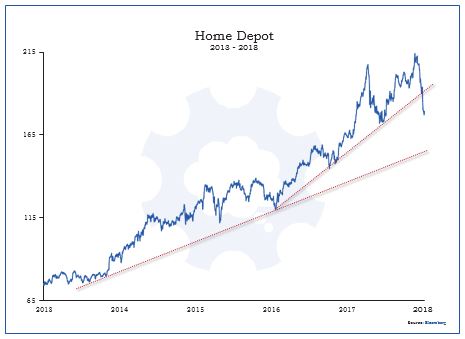

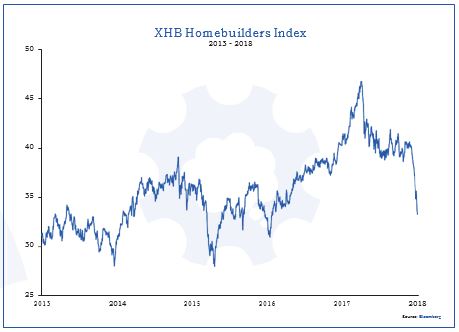

The complacency also continues despite the expiring coal mine canaries called Zillow and Redfin. As you can see, their stock prices are indicating just a smidge of malaise. And as Grant points out, this is also true of the homebuilder stock index, not to mention building supply colossus Home Depot.

Source: Bloomberg, Evergreen Gavekal as of 11/12/2018

Source: Bloomberg, Evergreen Gavekal as of 11/12/2018

After what we went through a decade ago, one would rationally think that such ominous action in this sector—which has consistently proven to be on the leading edge for the economy at large—would be enough to shatter the complacent zeitgeist. But, alas, it is not.

A veteran market observer might also think that after the near-death experience the Planet Earth’s financial stocks went through back in 2008 and 2009, a swan dive in their share prices would be sounding strident alarm bells. As you will shortly read, even US financial stocks are behaving very badly (shattering the myth that they are slam-dunk winners from higher interest rates). Particularly stunning is the fact that one of the most important banks in the world, Germany’s gigantic Deutsche Bank, is now trading below its financial crisis trough. But, once again, there’s scant concern about the severity of the price breakdowns.

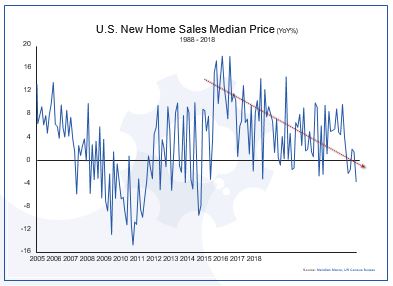

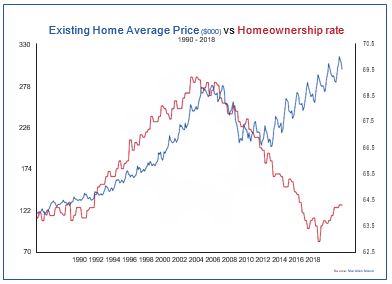

As Grant shows, it’s also surprising that with median new home “values”* now falling on a national basis there isn’t some serious trepidation in the air. But, instead, most investors seem much more in the greed, rather than fear, mode.

It further doesn’t seem to distress the US investor class that 70% of US residential markets now have prices above where they were during the mother of all housing bubbles. Or that America’s housing industry is caught in the crosshairs of a Fed with new-found spunk. If you listen to what it is telling the world, this Fed is determined to continue its unprecedented “double-tightening” campaign (both raising rates and selling hundreds of billions of bonds from its bloated balance sheet, the latter equating to even more rate hikes). Considering that the Fed is dealing with an economy running at full potential, with building inflationary pressures, housing is not likely to catch a break anytime soon…at least, not until financial markets really break.

As I speculated in a recent interview with Grant, I believe the so-called Fed Put (i.e., the notion that our central bank will ride to the market’s rescue whenever it sells off) still exists. However, I also believe under Jay Powell the strike price (or the level at which it might consider reversing to its former “Big Easy” status) is much lower than most investors believe. How much lower? Admittedly, this is just a guess but I’d say 30% below the S&P’s September peak.

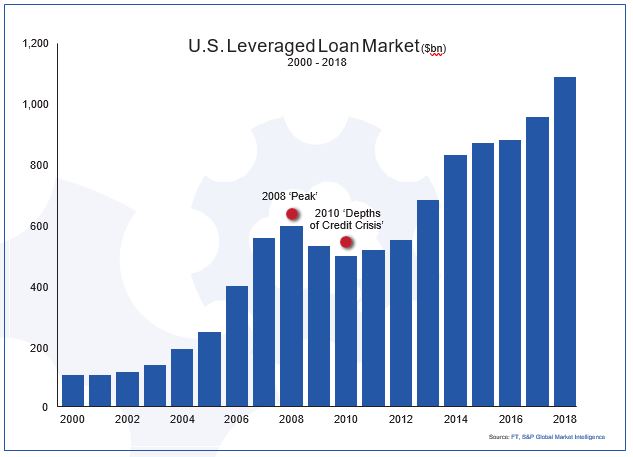

Lastly, Grant is also homing in on something Evergreen believes is a key risk—the leveraged loan market. This is basically the floating rate equivalent of the junk bond market and, like housing, it is also extremely vulnerable to the Fed’s double-tightening process. It’s additionally Evergreen’s belief that trouble in the corporate bond market (et tu, GE?) is going to be one of the triggers of the next crisis.

Now, to the master himself…

* Just ask any non-trust fund millennial out there how much of a value houses are these days!

David Hay

Chief Investment Office

To contact Dave, email:

dhay@evergreengavekal.com

BRIFFITS & SQUEANS, BLURGITS & PLEWDS

By Grant Williams

[Editor’s note: The article was too long to present in its original form. Breaks in writing are marked with ellipses.]

In 1980, Addison Morton ‘Mort’ Walker, a man best known for creating the newspaper comic strips Beetle Bailey in 1950 and Hi and Lois in 1954, published a book entitled The Lexicon of Comicana which has subsequently become something of a bible for cartoonists.

In his book, Walker gave names to the shorthand symbols which, without our realising it, had, for decades, brought flat, two-dimensional images to life in the most extraordinary way.

Until The Lexicon of Comicana’s publication, nobody had given much thought to what the clouds of dust that trail behind fast-moving characters or linger in a spot where a character had suddenly dashed out of frame were called. They simply ‘were’.

Walker decided that needed to change and so he filed them under ‘B’, for ‘briffits’.

While he was at it, he decided the bubbles and open asterisks representing popped bubbles that appear over a drunk or sick character’s head should be christened ‘squeans’ and the drops of sweat emanating from a character’s head to indicate nervousness, stress, or working hard should henceforth be referred to as ‘plewds’.

‘Blurgits’ (in case you are wondering) are the parenthesis-shaped symbols used to indicate less intense movement, such as a nudge, shoulders shrugging, or slow walking and, while we’re at it, allow me to offer you a few more extracts from The Lexicon of Comicana so you can astound and amaze your friends.

The squiggly lines placed over an object to indicate radiant heat? Those, my friend, are ‘indotherms’.

‘Agitrons’ are the longer wiggly lines around something that is shaking or vibrating and ‘wafterons’ are both the squiggly solid shapes that taper to a point on both ends, used to indicate strong odors, either positive or negative (the former typically filled with white, the latter with a sickly green) or, in their smaller form, when drawn above warm food items (like a pie cooling on the windowsill) will typically indicate both heat and odour.

There. Tell me you can’t win a bet or two in the pub armed with that information.

The Lexicon of Comicana does a wonderful job of corralling a bunch of nonsense into a handy compendium so it seemed like the perfect way to introduce this week’s Things That Make You Go Hmmm... because, as is always the case when I take one of my rare publishing hiatuses, there has been a whole bunch of nonsense bubble up since my last edition – any single thread of which could form the basis for an entire edition of Things That Make You Go Hmmm..., so I thought we’d spend this week catching up on a couple of them.

We begin with the stealth deterioration of the U.S. housing market.

The collapse of the housing market just a decade ago was the epicentre of the most turbulent period in the global economy since The Great Depression.

It’s extraordinary that we seem to need reminding of the depths to which our collective despair sank in the dark days of 2007-2009, but all that lovely printed money courtesy of the world’s central banks has clearly dulled the senses (just as it was intended to do).

By way of a reminder, the U.S. housing sector was, at the time, ‘systemically important’ – important enough that its decline brought the entire world to the brink of catastrophe and, though I hate to be the bearer of bad tidings, I have to tell you that nothing has changed.

OK, so maybe some things have changed in the financial circus that surrounds the U.S. housing market, but its importance remains undiminished.

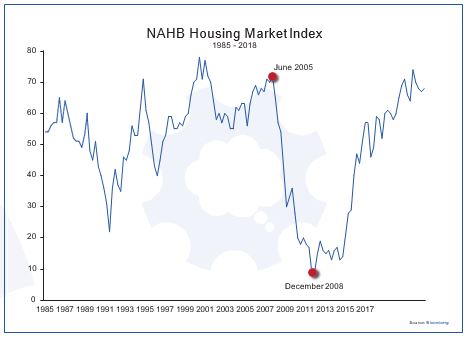

As you can see from the chart below, the NAHB Unbridled Optimism Index Housing Market Index has turned down in the last few months after a series of wobbles. This index measures the views of respondents to the question of whether the market for new homes is good or not.

The respondents are all homebuilders.

Noticeably, their views on housing began souring in June of 2005, long before the depths of the 2008 Credit Crisis.

We’ve seen similar pullbacks in sentiment going back to 2013 and each time optimism has returned, but this time, something else is occurring alongside the about-turn in sentiment; homebuilders’ stocks are getting battered.

Lately, the S&P500 has begun catching down to this key driver of the economy but it will be important to keep watching the homebuilders for signs of continued weakness.

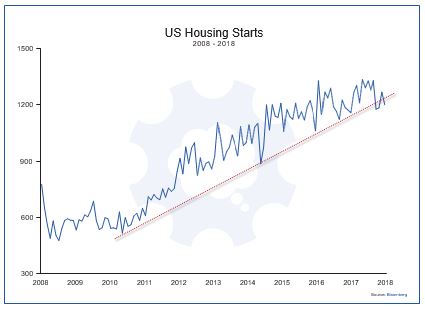

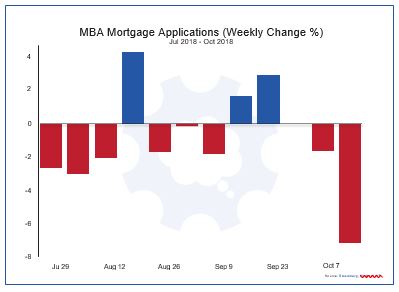

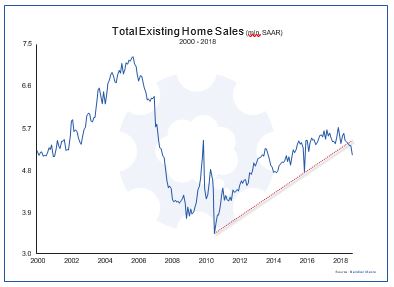

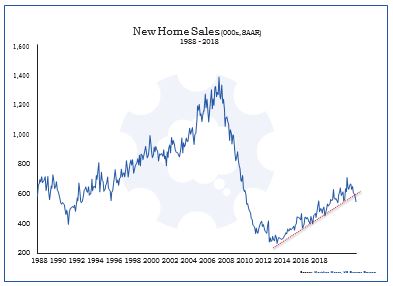

Elsewhere in the housing sector, starts are in the process of breaking, testing and re-breaking the trendline they’ve ridden higher since the 2010 low and that, of course, has much to do with the steady increase in interest rates which is having the inevitable follow-through into mortgage rates which in turn is feeding through into the number of applications for mortgages.

You’d be hard-pushed to call this rocket science (or even ‘remotely unpredictable’) and yet the stealth decline in housing has been more or less completely ignored (at least until now).

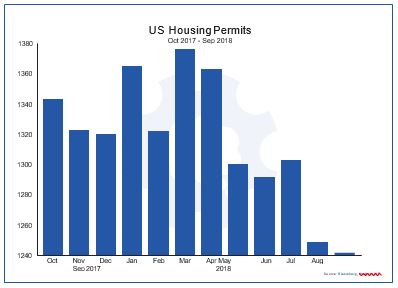

Housing permits (which had been robust) have also fallen off a cliff in the last five months so respite from the faltering housing market is proving hard to find.

Anecdotally? Also not good. Manhattan real estate is suffering just as a slew of new condos (built with QE-level financing) are about to hit the market:

(CNBC): What started as a blip is now a year-long slump for Manhattan real estate. And it shows no signs of turning around.

Total real estate sales in Manhattan fell 11% in the third quarter compared with a year ago, marking the fourth straight quarter of double-digit declines, according to new data from Douglas Elliman Real Estate and Miller Samuel Real Estate Appraisers & Consultants.

It was also the first time since the financial crisis that resales of existing apartments fell for four straight quarters.

Prices fell, inventory jumped and discounts were higher and more common. Real estate brokers say the Manhattan real estate market is suffering from an oversupply of luxury units, a decline in foreign buyers and changes in the tax law that make it more expensive to own property in high-tax states.

“We’re in reset mode, and I think we still have a little way to go,” said Jonathan Miller, CEO of Miller Samuel. “It’s way too early to think about the market seeing significant improvement.”

The average price of a Manhattan apartment fell 4 percent during the quarter, to $1.93 million, while the median price fell 5% over the last year to $1.1 million. There is now a seven-month supply of apartments, up from five months in the third quarter of 2017.

...and Manhattan is just a highly visible local symptom of what is looking more and more to be a national disease:

(Reuters): Sales of new U.S. single-family homes fell to a near two-year low in September and data for the prior three months was revised lower, the latest indications that rising mortgage rates and higher prices were sapping demand for housing.

Though housing accounts for a small share of gross domestic product, it has a bigger economic footprint. That is raising concerns that protracted housing market weakness could eventually spill over to the broader economy. Residential investment contracted in the first half of the year and is expected to have declined further in the third quarter.

“It is increasingly apparent that homes are getting too expensive to afford both on price and on financing costs,” said Chris Rupkey, chief economist at MUFG in New York. “One thing is for certain, the economy cannot grow at a sustainable 3 percent pace for long if new home sales continue to tumble.”

ECRI’s Lakshman Achuthan recently weighed in with his thoughts on where housing is in the cycle and, spoiler alert, he didn’t have much to offer in the way of a positive spin:

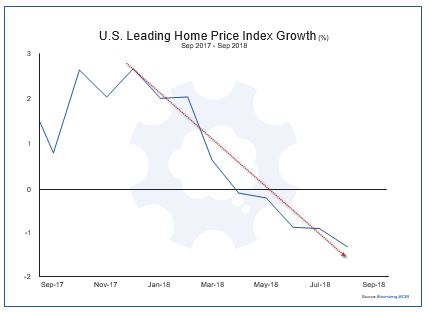

(Bloomberg): Despite a robust U.S. economy, at least as measured by gross domestic product, real home price growth is locked in a cyclical downturn. If that’s not bad enough, it will likely get worse based on the same approach and factors that correctly flagged the housing bust — in real time — in early 2006.

Home prices are highly cyclical and, as everyone discovered from the last recession, their movements can have material consequences for the broader economy. Yet, according to the minutes of the Federal Reserve’s Aug. 1 monetary policy meeting, policy makers are only starting to recognize the “possibility” of a significant weakening in the housing sector as a “downside risk.” Our research suggests that real home price growth has already entered a cyclical downturn that is likely to intensify. Data this week is forecast to show a drop in housing starts and existing home sales.

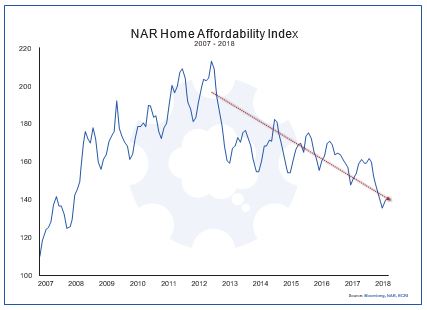

Part of the reason for the worsening outlook in home prices is the plunge in housing affordability, which is generally a function of the ability of a family with median earnings to buy a home at the median price. This metric — the National Association of Realtors’ Housing Affordability Index — recently dropped to a 10-year low, partly as a consequence of rising mortgage rates. But it’s not just about higher borrowing costs. Affordability has also been undercut by the steady rise in the ratio of median existing home prices to the median earnings of full-time wage and salary workers. This ratio recently reached a 10-year high, with the median cost of purchasing a home equaling almost six years of a worker’s earnings before easing slightly, according to our research.

The homebuilders have fallen 36% this year making them by far the worst-performing sector in the S&P 500, and the move has taken them to the sort of level normally associated with recessions.

(Dallas News): “The continued slowdown in the rate of home price appreciation nationwide and in many local markets is a rational response to worsening home affordability -- which has deteriorated at an accelerated pace this year due to rising mortgage rates,” Daren Blomquist, senior vice president at Attom Data Solutions, said in the report...

Median home prices are now higher than they were before the economic downturn in almost 70 percent of the markets Attom Data tracks.

…

Elsewhere, as the Wall Street Journal points out, the signs are increasing that we are potentially entering a phase in the housing market that we’ve seen all too recently:

(WSJ): Affordability is “already more stretched...than it has been in previous cycles,” said Aaron Terrazas, a senior economist at Zillow.

Real-estate agents say power is shifting more toward buyers. They now have a number of homes to choose from within their budget and feel they need to weigh their options, knowing their home may not appreciate nearly as quickly in the coming years.

Buyers have also returned to putting contingencies on their purchases to protect themselves if the home has hidden physical flaws or doesn’t appraise at the purchase price—a practice that was often waived to make offers stand out during bidding wars when the market was hot.

“Home inspections are back,” said Joselin Malkhasian, a Realtor in Boston who added she has done more home inspections in the past month than in the past year.

Alongside weakening house prices and the return of home inspections (who’da thunk it?), there has been a curious level of weakness in stocks like Home Depot and Lowe’s – both of which saw recent downgrades by Wall Street analysts:

(Investors Business Daily): Home Depot stock was cut to neutral from outperform and had its price target slashed to 204 from 222 by Credit Suisse analyst Seth Sigman, who also downgraded Lowe’s stock to neutral, while its target was cut to 111 from 115.

“Our key concern is that home prices will continue to moderate, at least temporarily, as higher rates weigh on affordability, and inventory creeps up,” Sigman said in a research note.

Without a major demand problem apparent, he noted that the pace at which home prices moderate will indicate if the recent rate-driven housing market weakness is the “beginning of a soft landing, or something worse.”

The weakness in housing and the related stocks we’ve chronicled in the previous pages has run headlong into inflation fears over rising raw material costs and, to complete the perfect storm, rising interest rates.

The most remarkable thing is that, with interest rates rising steadily for almost three years now, this stealth bear market in housing (which is a natural and perfectly predictable result of moving from all-time low interest rates to a semblance of normalcy) seems to have gone largely unnoticed and crept up on investors distracted by the all-powerful FAANG stocks.

With FAANG starting to wobble in recent weeks, focus is starting to broaden and, with increasing peripheral vision comes an increasing awareness that there is something wrong in the engine room of America’s recovery.

You can bet your bottom dollar that we’ll revisit the housing market in the coming months but, before we move on to our second topic this week, here are a few timely charts from the brilliant Eric Pomboy of Meridian Macro who dropped these into my inbox just as I was preparing this piece:

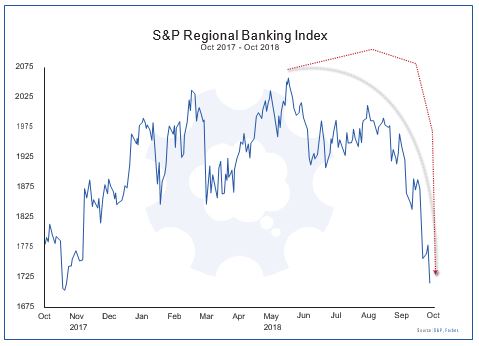

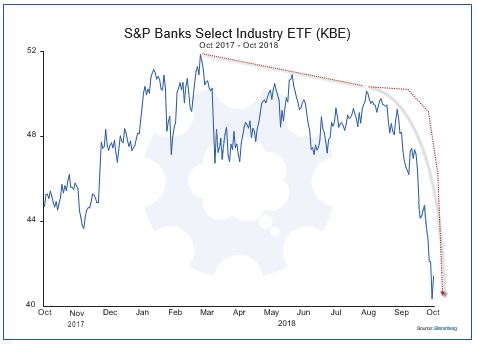

The rising interest rates which are starting to hamper the housing complex would normally be a boon to our second group of companies this week, but, as we’ll see, that is not turning out to be the case.

Something is severely out of whack with a collection of companies which are the obvious next domino to fall should the real estate market continue to perform poorly.

I’m talking, of course, about the banking sector – the one group whose solid performance is common to every strong economy and the one group of stocks which always suffers a hangover.

The softening housing picture is one component of the decline in the overall real estate market but, after 2008, many banks were dissuaded from lending to homeowners on such generous terms as they had done prior to the meltdown so, with zero percent interest rates and deposits burning a hole in their pocket, they just couldn’t help themselves and the obvious place to go to find better, more reliable borrowers was, naturally, the commercial real estate sector (CRE).

These guys are professionals. What could possibly go wrong?

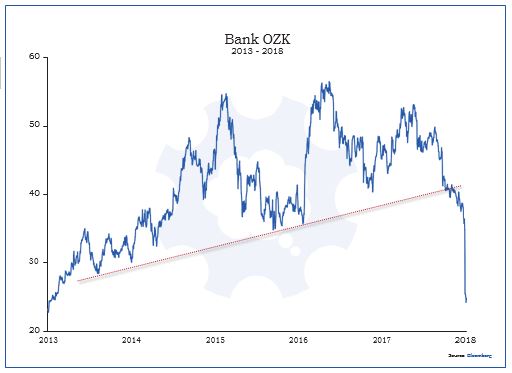

(Forbes, October 22, 2018): Bank OZK lost more than a quarter of its value on Friday after the Arkansas- based lender (formerly known as Bank of the Ozarks) wrote off about $46 million in commercial real estate loans on two unrelated projects in North Carolina and South Carolina.

Though the projects, which have been in the bank’s portfolio for about 10 years, already had been classified as “substandard,” the bank said new appraisals “reflected the recent poor performance of each project” – an indoor shopping mall and a residential project.

Regarding the retail property, CEO George Gleason told analysts “the appraisal’s focus changed significantly from an operating property that will continue to replace tenants and go forward to a property that would just essentially melt down.”

OZK reported Q3 diluted earnings per share that were 23% below Q3 2017. The bank’s ratio of nonperforming loans as a percent of total loans, excluding purchased loans, was 0.23% as of September 30. That compares to 0.11% a year earlier and 0.15% at the end of June.

OZK’s performance was a surprise to analysts (aren’t these things always), but the usual signs had been present in the months leading up to the company’s disastrous Q3 earnings – including the usual symptom of such things; overreach:

(Forbes): The bank has been reaching out beyond its home territory of Arkansas in recent years, emerging as a leading CRE lender in major markets such as New York City, Chicago and Los Angeles.

Of course it has.

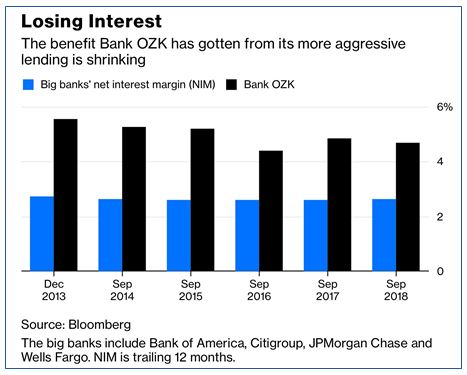

Alongside the plunge in the regional bank index (chart above), as you can see from the chart below, the malaise in the local banking sector has enveloped not just the OZKs of the world, but the broader sector as a whole, and the fear (as they always are) surrounds whether the poor performance of OZK (and particularly the reasons for that poor performance) are symptomatic of something far more insidious:

(Bloomberg): The bigger problem for OZK, and potentially the nation’s largest banks, is that its commercial real estate portfolio, which [Carson] Block and others have warned about, appears to be starting to turn bad. OZK reported that its expense for credit losses rose 439 percent to nearly $42 million, the result of two relatively large real estate loans, which had been on OZK’s books for more than a decade, going bad.

A number of bankers, including Wells Fargo CEO Tim Sloan, have warned recently about potential problems in commercial real estate lending. And Sloan is the one who should be most worried. Wells Fargo has the largest commercial loan portfolio of the big banks at $145 billion, which was showing signs of early trouble in the first quarter, but appears to have improved lately.

The big banks include Bank of America, Citigroup, JPMorgan Chase and Wells Fargo. NIM is trailing 12 months.

But where OZK could signal a truly significant problem for the banks is interest costs...So far it hasn’t been a problem for the big banks, but it appears to be a growing problem for OZK.

In the first nine months, OZK has had to increase what it pays on deposits by 0.53 percentage points, yet it has only been able to increase the average interest rate it charges on its loans by 0.31 percentage points. A similar squeeze would cost JPMorgan Chase & Co., for example, as much as $1 billion in revenue.

…

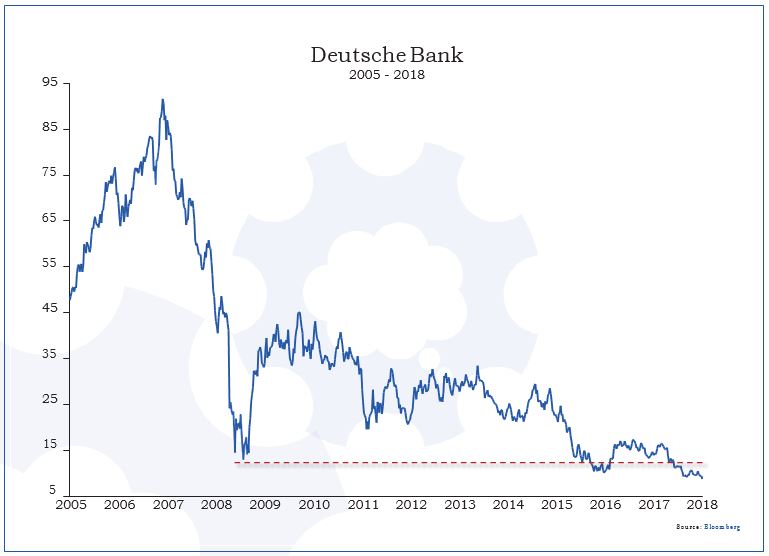

There’s another banking behemoth which is not only the epitome of too big to fail, it’s also failing.

I’m talking, of course, about Deutsche Bank which currently sits roughly 50% below its 2009 lows and which looks, for all the world, as though it’s heading to zero.

In the wake of last week’s results announcement, the press had a field day:

(Forbes): The Deutsche Bank CEO... [Christian] Sewing must convince shareholders that Deutsche Bank has a future at all. And these results do absolutely nothing to help him. They are frankly abysmal, and not just for the investment bank. Rarely have I seen such unrelenting gloom across all business lines.

Sewing did his best to talk it up, of course. “With profit before tax of 506 million euros, this result is another milestone on our way to becoming a sustainably profitable bank,” he said, adding: “We have our costs under control and sufficient capital to grow.”

Really, Christian? A leverage ratio below target and falling suggests that you don’t have enough capital to support your current asset base, let alone grow. And your investors are growing weary of repeatedly being tapped for more capital...

But Sewing was optimistic: “We are on track to be profitable in 2018, for the first time since 2014.”

Sadly, investors did not share his optimism. Deutsche Bank’s share price dropped to its lowest level since 1992.

Yes, it’s hard to believe that a global banking giant could find its equity trading at the same level it did over a quarter of a century ago, but that’s precisely where Deutsche Bank finds itself and the company’s Q3 numbers were... how do we put this charitably? Forbes, help me out here, would you?

(Forbes): The third quarter results show that revenues are flat or falling across the board. Not a single business line has turned in a respectable profit. Even Global Transaction Banking, on which Sewing had pinned his hopes for a strong and stable income stream, wobbled. And although Asset Management delivered a profit, underlying it is a slow-running hemorrhage. Sewing’s “pivot to Europe” is failing.

I said ‘charitably.’ Oh never mind.

Of course, the answer being touted to solve the problem of Germany’s biggest bank is... to make it bigger:

It is becoming hard to see that Deutsche Bank has a future as an independent bank. But there are not many players out there capable of taking it on as a going concern, and even fewer that would want to.

One possibility being discussed is a merger with Commerzbank, though at present Commerzbank doesn’t seem all that keen. Bolting the two ailing German giants together might perhaps create a bank large enough to compete with the Americans, though it’s a risky strategy - mergers of this kind can have the unfortunate effect of amplifying the weaknesses of both banks.

Sigh...

Once again, we find ourselves at a critical juncture.

The residential real estate market in the U.S. is visibly softening and the first signs of stress are emerging in the country’s commercial real estate market. Add in a banking sector that is clearly beginning to face headwinds in a rising rate environment and you have the building blocks for something we all recognize.

All that’s missing, in fact, are a problem in the credit markets and a former Fed chair warning about the dangers of things that they themselves did more than just about anybody else to enable:

(FT): The US needs to deal with a “huge deterioration” in the standards of corporate lending instead of focusing on deregulation, Janet Yellen has warned.

In an interview with the Financial Times, the former chair of the Federal Reserve said she was particularly alarmed by loosening standards in the $1.3tn market for leveraged loans, which are offered to companies with weaker credit ratings.

“I am worried about the systemic risks associated with these loans,” said the former central banker. “There has been a huge deterioration in standards; covenants have been loosened in leveraged lending.”

There was a risk lessons from the crash were being forgotten, as banks embark on an aggressive lobbying push to water down reforms that were put in place at the start of the decade, Ms. Yellen told the FT.

“There are a lot of weaknesses in the system, and instead of looking to remedy those weaknesses I feel things have turned in a very deregulatory direction.”

Ok, so what do I have for you in the remaining pages of Things That Make You Go Hmmm…this week? Well, in a word, plenty. (To access Grant’s full newsletter, and to read “The Plenty,” please click here.)

OUR CURRENT LIKES AND DISLIKES

Changes highlighted in bold.

LIKE *

* Some EVA readers have questioned why Evergreen has as many ‘Likes’ as it does in light of our concerns about severe overvaluation in most US stocks and growing evidence that Bubble 3.0 is deflating. Consequently, it’s important to point out that Evergreen has most of its clients at about one-half of their equity target.

NEUTRAL

DISLIKE

* Credit spreads are the difference between non-government bond interest rates and treasury yields.

** Due to recent weakness, certain BB issues look attractive.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.