Saving for college can be daunting. Many parents are saving for their children’s education, but don’t know how prepared they will be for college costs in the future. Parents face the question of how much to save and which funding vehicles to use. Those with young children have uncertainty regarding what the future will look like and if their kids will attend university. We recommend reviewing college savings within the context of your financial plan, modeling out projected funding levels against education costs, and saving for a specific target.

How Much Will Education Cost?

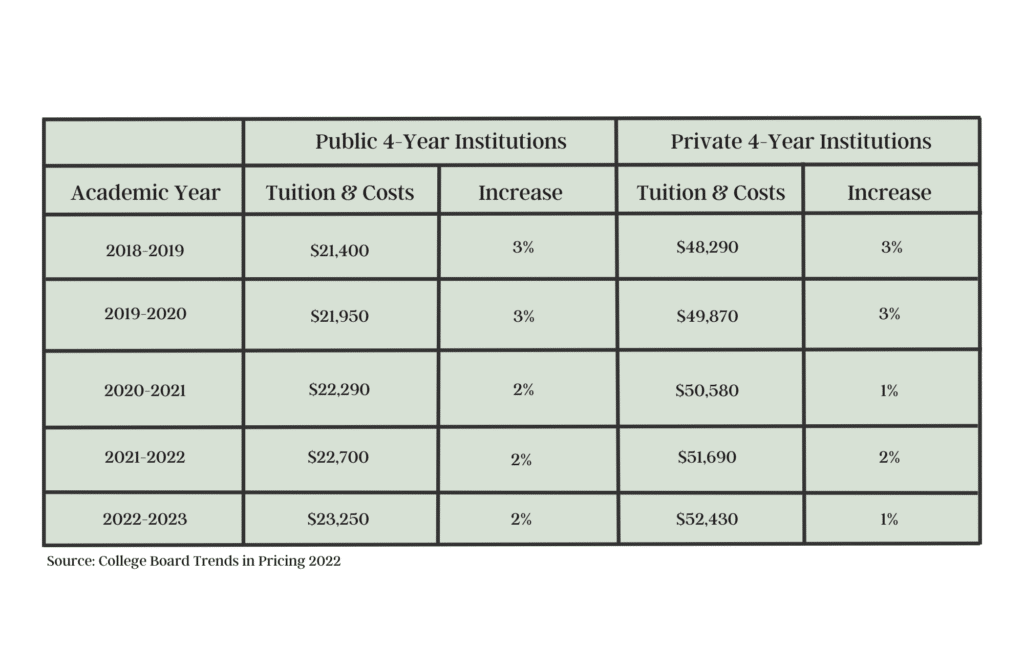

What are the current costs for higher education? See charts below for current costs for public and private schools, as well as recent inflation rates.

When reviewing costs, consider potential financial aid available through the Free Application for Federal Student Aid (FAFSA). Many students qualify for some kind of financial aid even if their families earn a high income, as the FAFSA calculation considers the size of your family, other family members in school, and the cost of attendance. In 2021-2022, undergraduate students received an average of $15,330 in financial aid, with $10,590 coming from grants, $2,780 in federal loans, $870 in education tax credits and deductions, and $90 in Federal Work-Study. [1] Encourage your child to apply for merit-based aid that is offered by the university.

Which Funding Vehicles to Use?

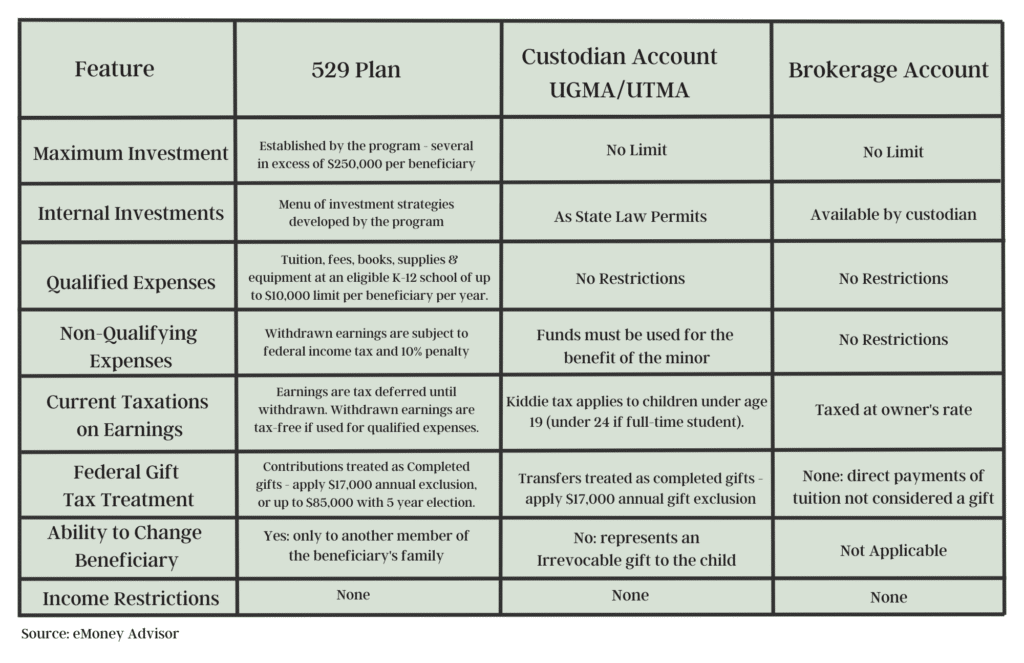

There are a variety of accounts you can utilize to save for college, and each has their pros and cons relating to tax benefits and access to funds. 529s are the most tax-favorable accounts, as they function like Roth IRAs for education, that is they are funded with after-tax dollars, they grow tax-deferred, and qualified distributions are tax-free. However, there are limitations with these funds, and many parents have concerns about how to use these funds if their child does not go to college. Many opt for a diversified type of approach, utilizing 529s as well as taxable accounts or custodial accounts that can be used for college expenses or can give more flexibility to the child to pay for a first home or start a business. No matter which account type you select, start saving as early and as often as possible. We recommend automating your savings on an ongoing basis, which can help reduce market timing risk.

The chart below details the most common college savings accounts.

Leftover 529?

If you have additional funds left over after paying for college, you can change the beneficiary to another family member such as a sibling or a cousin. 529 plans can be passed on to the next generation and be a legacy planning tool, but gift taxes occur so review this strategy with a CPA.

The SECURE Act 2.0 created the ability to rollover a lifetime maximum of $35,000 from a 529 to a Roth IRA for the named beneficiary, starting in 2024. [2] The 529 accounts must be opened for 15 years, and the rollover occurs using the 529 to fund annual Roth IRA contributions (currently $6,500/year per person, or $7,500 for those 50+). Still, this creates an opportunity to start retirement savings as soon as the beneficiary has earned income.

Education strategies vary significantly based on individual circumstances. We recommend reviewing within your financial plan to figure out how to optimize your savings strategy and determine if you are on track to fund your loved one’s education. If you are interested in learning more about how Evergreen helps with education planning, click here to take our client compatibility survey and speak with an advisor.

[1] https://research.collegeboard.org/trends/college-pricing

[2] https://www.congress.gov/bill/117th-congress/house-bill/2954/text

Katie Vercio, CFP®

Senior Financial Planner

To contact Katie, email:

kvercio@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.