Goals and Discipline:

We all have friends who talk about their diets. I’ve always been struck by the fact that people who like to talk about them the most are typically overweight. In fact, I can’t remember the last time I heard a skinny person going on and on about his/her formula for success. In dieting and investing, it would seem that self-discipline plays a crucial role. So, what does self-discipline mean for investors? I think it can be a number of things, but here are some of the most critical elements as it relates to investment discipline.

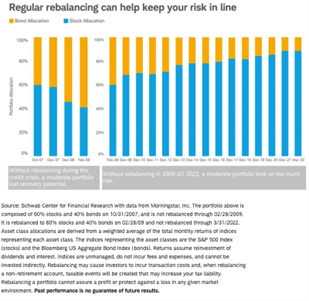

I’d like to stay focused on the last point. Most people I talk to can answer the question “what’s your asset allocation to bonds and stocks?” However, my next question usually stumps them: “Is that your allocation by design or by accident?” Take a look at the following chart by Liz Ann Sonders, Chief Economist at Charles Schwab:

This chart is a warning of what can happen to someone’s allocation over time if it’s not monitored and re-balanced. There are two bar charts both depicting what would happen to a 60%(stock)/40%(bond) portfolio in two different market periods if left to “drift” with markets. The period on the left was the Financial Crisis and the period on the right was the subsequent 12-year bull market that followed.

Back to the question I ask people: “Is your asset allocation by design or accident?” What this chart highlights is that a portfolio’s asset allocation can be massively altered by market fluctuations. In 2008-09, a 60/40 (stock/bonds) portfolio, if unadjusted, fell to 40/60. This means that an undisciplined investor who didn’t re-adjust their portfolio had 33% less equities than they actually intended. More strikingly, a 60/40 portfolio that started at the beginning of the bull market, absent of rebalancing, rose to almost 90% stocks which is a massive and likely unintentional increase in the portfolio’s risk.

I’d like to think that many firms, including Evergreen, consciously took steps to maintain these allocation targets but, in reality, we know first-hand the challenging conversations this requires with clients. There are also often tax considerations in reducing holdings that have performed well. However, many advisors skip those conversations, opting instead to ride the wave on the way up and right back down. We are fortunate in many cases to have knowledgeable, experienced and like-minded clients who understand the importance of being disciplined. To that end, I wonder how many people who started out 12 years ago as 60/40 accounts were truly 60/40 as we entered the current correction. Few, I’d guess.

What’s worse, is that clients who were 60/40 12 years ago are now that much older. They should likely be in even more conservative allocations based on their increased age. This may be a sobering reality for many investors who were undisciplined and way out over their skis.

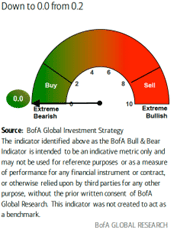

The headlines of late have been anything but optimistic and investors are no doubt paying attention to the news flow. Here’s a recent chart displaying current investor sentiment, where it sits at ZERO, indicating everyone is bracing for impact.

Given this sentiment chart, it’s no surprise that markets are skidding. It’s also important to remember that the financial markets are typically the canary in the coal mine. In early 2009--well before the extent of damage to the financial system would fully play out, before collapsing real estate prices, and prior to widespread job losses--the stock market had already seen its bottom. Because the stock market is highly liquid, significant changes to a portfolio can be made in a few clicks of a button. Changes for private companies and the economy at large don’t happen at that pace. Home purchases can’t be settled in 2 days like the trading of a stock. This is a reminder that in downturns, financial markets typically are the first to fall but they are also the quickest to recover. By the time the economic news turns rosy, it’s highly likely that few bargains will remain in the markets.

Exercise isn’t enough:

It’s often said that the Fed is in command of the “punchbowl” at the party. Pundits have been saying for years “we need to take away the punch bowl” or “the longer the binge the longer the hangover.” Sure, I can see those analogies. After all, people were certainly getting rich because money was so cheap to borrow. House prices soared, the stock market climbed, cryptos defied gravity and who wanted to end that party? Well, it turns out a party crasher arrived, but it wasn’t Covid, it was inflation. It’s well documented how quickly the markets rebounded from Covid-induced panic selling in March of 2020. Many thought we had whistled passed the graveyard, but as it turns out, the pandemic had set into motion an inflation shock that has sent markets reeling.

At this point, it’s clear that the Fed and central banks around the world will now attempt to combat inflation with interest rate increases aimed at slowing the economy, even it that mean’s tipping it into recession. Sure, they say nice things like “soft landing” or “thread the needle” in an offer of hope to investors that there could be a happy ending to the story. In reality, the seemingly singular focus on interest rates as the cure for the current ailment vastly oversimplifies the problems we are facing.

This brings up a different analogy than the “punchbowl.” Studies have shown that exercise, for the goal of weight loss, is significantly less important than diet. The Fed, whether it realizes this or not, is playing the role of personal trainer. They are strapping us on a treadmill, turning up the speed and increasing the incline. The idea that putting an overweight person on an impossibly rigorous exercise regimen will miraculously lead to overnight results is ludicrous. The more probable result is a heart attack!

Now, should the Fed have been more forceful in their workouts for the economy in the times leading up to this point? Yes! But simply forcing the economy to workout harder at this point is unlikely to succeed. We need a more comprehensive approach to our weight loss. As apparent as it is that you can’t “get in shape” overnight by working out extra hard, the Fed and policymakers would be wise to consider a more wholistic approach.

There are three primary forces powering the current ballooning inflation: housing, energy, and supply chain disruption. If central banks raise rates high enough, they’ll eventually break the economy and there’s no doubt that if they hurt the economy enough inflation will subside. But this a very blunt approach. So, let’s examine this a bit further…

Housing:

On the surface it may seem logical to argue that raising interest rates will bring down home prices since mortgages become more expensive. However, this seems to be too simplistic. Sure, there is a temporary shortage of materials and this has been a disincentive over the last couple of years for those wanting to build a house. But there are two other factors worth noting:

There’s no one I know who works in any form of real estate development who says it’s easier to develop now than it was 10 years ago. We don’t just need to slowdown rising prices on existing housing, we also need to build more homes. This will require less regulatory red tape and more construction workers. The good news is that inflation may force more workers back into the labor market, helping drive the latter point. But it’s difficult to understand how raising the cost to borrow alone (i.e., higher interest rates) will help alleviate a global housing shortage over the long run.

Energy:

Many have championed the need for green energy. Politics aside, anyone who studies this industry in detail will tell you the same thing. Even if we completely banned fossil fuels tomorrow, green energy is nowhere near ready to provide the capacity needed to power the global economy. This isn’t to say a move toward green energy should be abandoned altogether, but we do need a realistic plan to transition from one to the other. Doing so at a reckless pace is sure to cause existing energy companies to underinvest in growth which only leads to continual shortages …and higher prices. We are clearly seeing this play out today, particularly in Europe.

Another complication to our current energy situation is Russia’s invasion of Ukraine. For a long time, the narrative was that the US was too dependent on foreign oil. It was a national security risk that many dreaded. Advances in drilling allowed the US to become self-sufficient for the first time in 50 years. (An important clarification is that the US still needs to import the heavy oil for which our refining complex is better suited; however, we are now a major exporter of light crude that many overseas refiners must use). As a result, low oil prices seemed to be the new norm. With low oil prices, the regulation of oil and gas gained momentum. I take no political opinion here, but I would point out that when gas prices are low, the environment becomes the priority. However, when gas prices get too high, people’s thinking shifts.

Further, complicating matters with respect to the role of oil and gas in the US, we have been watching the fate of countries that rely on foreign energy. There are very few people, Democrat or Republican who think it’s a good idea to be at the mercy of Russia or the Middle East for our energy needs. So as the US contemplates the tradeoffs between energy independence and the environment, oil and gas companies, too, are waiting for clarity before commitment billions of dollars to produce more.

Again, I would ask how increasing interest rates will lead to lower energy prices? In fact, it will likely have the opposite effect as the cost of borrowing for companies who want to expand has exploded. On the positive side, energy companies are generating so much excess cash at these price, even with oil pulling back to around $100, that they can easily fund exploration and development. That is, if they feel like they are not going to be attacked for expanding output or even simply trying to maintain their production.

Supply Chains:

If the pandemic reminded people of one thing, it’s how interconnected the global economy has become. To pick one illustrative example, look no further than new and used car prices. New car sales have been stunted by a global chip shortage. Every car company in the world is failing to meet demand due to this shortage. In turn, with very few new cars to sell, consumers have turned to the deeper market of existing/used cars. This has caused the prices of “pre-owned” cars to climb faster than that of new ones! It used to be that your new car fell the moment you drove it off the lot. Now it goes up the moment it leaves!

We’ve all read the stories of the countless floating container ships off our ports with no one to unload them. And look at the trucking industry where we are experiencing the greatest shortage of drivers in American history. Yes, there are aspects of the supply chain that are admittedly out of our control. The continued lockdowns in China continue to drag out delaying a return to the normal functioning of supply and demand. Ultimately, these supply chain issues will be resolved and shortages will eventually be replaced by surpluses, but that will not happen overnight. One has to wonder if there’s been a more permanent change in the mindset of corporations. Sure, cheap labor from abroad has been a huge tail wind for profitability, but we are now being reminded of the tradeoff involved in offshoring labor. As executives review their strategy, perhaps providing fresh allure is a supply chain that’s more in their control.

I’ll ask again one more time: How will raising interest rates help correct these supply chain issues? It would seem prudent to find more creative ways to un-kink our global supply chains through both our own domestic policy improvements as well as establishing new or revised trade agreements with other countries.

Housing, energy and supply chain shortages are issues that will not go away quickly. In many ways, key discussions that should have been had long ago are now being forced upon us. An optimist could argue that we are now sowing the seeds to help alleviate repeated inflation spikes by the same forces again in the future. In my opinion, addressing these issues, many of which are long overdue, is akin to eating a healthier diet.

Conclusion

The Fed, for all its faults, cannot be blamed for the entirety of this as it does not control all these levers - perhaps thankfully given its track record! The Fed can use interest rate policy to “whip” us into shape, but if we continue to eat an unhealthy diet and rely on exercise alone, it will not lead to a healthy lifestyle. I find my self-wondering if the resulting effects of this attempted “rigorous” exercise routine is going to lead to an even worse outcome than if we employed a more patient approach. Perhaps, the Fed feels helpless and since healthier eating is in the hands of finger pointing politicians, they have no choice but to play the cards it has in its control – more exercise!! In this case, more and more “reps” of interest rate hikes.

Investors are now keenly feeling the pain of the rate hiking campaign the Fed has set into place. Bonds are off to their worst start in over a century. The stock market has taken a punch square on the chin, while the Nasdaq is trying to pick itself up off the canvas. Historically speaking, if the Fed pushes the economy into recession, things will surely get worse. But considering, the average stock market decline during a recession is 35%, a good chunk of the pain has already been felt by market participants. The Fed has pointed to strength of the economy thus far, but I find this disingenuous. The Fed knows what will follow as they continue on this mission to hike. The stock and bond markets are foreshadowing these events.

It’s likely that the bottom in markets won’t be put into place until the Fed signals it will stop raising rates. For that to happen, it’s hard to imagine anything besides an abatement of inflation to predicate such an action by the Fed. Given that inflation is a lagging indicator, it will be important to monitor data that could point to an inflation deceleration.

We expect there to be continued volatility in the markets both up and down in the interim. At the start of this piece, I showed that when investor sentiment gets this bearish (oversold) the market tends to bounce, at least in the short run. What’s becoming increasingly attractive is what’s happening within the technology sector -- companies are being sold indiscriminately. Those with shaky business models whose long term prospects are seriously in question such as StichFix, Robinhood, Toast, and Opendoor are down 70% or more. Perhaps, these deserve to be punished. On the other hand, companies like Meta (Facebook), DocuSign, Netflix, and Uber have also been clobbered and are all down over 55%. The latter companies are not going away. We like companies that have become verbs as it signifies just how woven into our lives their technology has become. The chance to buy these companies during this shakeout will be one of the benefits of the pain all of us are currently experiencing.

The current administration is in a very difficult bind politically. With inflation raging, Americans are likely to vote with their wallet over their heart. Ignoring their political or social merit, many of the policy proposals such as “Build Back Better”, “The Green New Deal”, and student loan forgiveness are seen by most economists as inflationary. It will be noteworthy whether the President decides to stick to his guns on these initiatives or recalibrates his agenda to focus on tempering inflation. As alluded to, I’m hopeful that policymakers on both sides will realize that they cannot singularly rely on the Fed to police inflation with the blunt instrument of interest rate manipulation. I acknowledge that some of the steps that could be taken will not lead to an overnight improvement in inflation. But housing shortages, high energy prices, and a globally intertwined supply chain will continue to present inflationary threats over the short-, medium-, and long-term if not addressed.

If there’s one thing that markets have reminded investors, it’s the importance of being nimble and tactical given all the dynamics that are in play. Gone are the days of buying virtually any asset and watching it soar. Today’s markets are far more discriminating. There will be winners and losers based on the fate of different events. It’s doubtful that we have seen the market bottom, particularly in stocks and bonds, I do believe that financial markets are far closer to turning the page than other parts of the economy. If we do see a recession where stocks historically decline 35% on average, the equity market, now down 20%, has already suffered ~60% of the expected fall. I should point out that not everyone thinks an economic recession is a certainty but, for the sake of context, investors should consider the possible implications of such an event.

As a firm, we are preparing for a range of outcomes as many crosscurrents continue to blow through the economy and markets. For investors like us, who value analyzing data and adapting to the rapidly changing landscape, we anticipate there will be plenty of opportunities in the coming quarters to make strategic investments and position our clients’ portfolios advantageously for the years ahead.

Tyler Hay

Chief Executive Officer

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.