“It is human nature to think wisely and act foolishly.”

-ANATOLE FRANCE

- Despite rapid advances in technology, the human brain remains far more superior to even the most powerful supercomputer.

- However, our brains have deficiencies that often lead to irrational and/or sub-optimal decisions.

- Some of these biases or tendencies are related to social fears and pressures. Others are a function of how humans evolved over the eons. These can lead to reactions or emotions that were appropriate in pre-historic times but are often counter-productive today. They include excessive loss aversion and fear of missing out.

- These flaws in our mental processing make the pervasive belief in efficient financial markets highly suspect since markets are only as rational as the underlying participants. By extension, this applies to the investment off-shoot of the Efficient Market Hypothesis: index-, or passive-, investing.

- Yet, the growing popularity of index-based investment vehicles reflects the belief on the part of a growing number of both investors and advisors that markets are efficient and, consequently, unbeatable.

- Evergreen disagrees with both the theory of efficient markets and the superiority of passive investing. Understanding our brain’s fallibilities and biases is crucial in avoiding the investment traps these create and in seeking to generate superior investment returns.

By Tyler Hay

How powerful is the human brain? Below is an image that graphically depicts how our minds stack up versus different processors including some of the world’s supercomputers.

As you can see, despite all the available technology and computing power, science still can’t create a machine with more processing power than the brain of a rat. Our minds are tremendously complex and have evolved over the course of human history. In 2009, a South African neuroscientist named Henry Markram gave a speech where he proposed building a computer-based replica of the human brain. Scientists, who are correctly not known for their creativity, named it the “Human Brain Project.” The group of scientists that set out to achieve this feat received over 1 billion euros in funding. The project was featured in Wired Magazine and Markram himself delivered a stunning 15-minute TED Talk. In his speech, he describes the history of our brains, their evolutionary future, and his vision for helping science get a better grasp of how this complex and vast organ functions. Some have said that it was Markram’s son’s Autism diagnosis that ignited his passion to hack the unhackable.

The project itself has struggled, bogged down in political agendas (how unusual!), power struggles (equally unusual), and Markram’s borderline manic obsession with his ambitious goal of recreating our brain through the power of science and technology. Whether or not this particular project succeeds isn’t the point. It’s a sign that science has undertaken a journey that will eventually end with unparalleled access into something we know so little about.

However, for all the brilliance that’s packed into the three-pound organ inside our head, it comes pre-programmed with some serious deficiencies. Take for example a study done by (Kahneman and Miller, 1986), which analyzed the behavior of professional soccer goal-keepers in top leagues and championships. The focus was save percentage for these goalies during a penalty kick. After studying over 286 penalty kicks, the statistics went as follows: A goal keeper had a 12% chance of making the save if they dove to the right, 14% if they dove left, and a 33% probability if they stayed in the center.* These are compelling numbers. Goalies are two-and-a-half to three times more likely to make a save if they simply don’t move! Knowing this, what percent of the time do you think a goalie stays in the middle on a penalty kick? The answer? Six percent of the time! How could this be? The answer lies in what’s called our “action bias”. We feel compelled to at least look like we tried. Clearly, this is an emotional reaction to what should be a rational decision. It highlights something interesting about our decision-making process; it is affected by more than just reason. We hold preferences and social components as key inputs to the decisions we make as humans.

Let me give two examples that suggest we override sound decision-making because of the presence of a social pressure. In 1973, Solomon Asch—a Stanford professor—conducted the following experiment:

First, Asch arranged participants into groups of ten people. Then, he asked this question: Which line on the right (A,B, or C) is equal to the line on the left? (He asked his participants to give their answers out loud.) The answer was C. It was easy and nearly everyone got this right. (Only the fact that this study was conducted in the Bay Area during the ‘70s could potentially explain how anyone missed it!)

However, what they did next was fascinating: Actors, who were instructed to intentionally answer question with an incorrect answer, were placed in some of the groups. The participant (not knowing he/she was among nine actors in the group) would be asked to answer last. After hearing the actors mistakenly choose a line other than C, guess what happened? The accuracy plummeted. After watching these “actors” give incorrect answers, the accuracy dropped to 60% on a question that most eight year-olds would answer with ease. What changed? Social pressure. It caused individuals to severely doubt their decisions. If their confidence was shaken on a matter as straight-forward as this, imagine the weight our friends or colleagues carry on decisions far less clear.

At Yale, psychologists tried the following experiment on a group a Capuchin monkeys to see how far back our aversion to loss may be linked. In the first scenario, one group of monkeys was given a single cookie. In the second group, the monkeys were given two cookies only to have one cookie taken away from them. In both scenarios, the monkey groups ended up with one cookie. However, the monkeys much preferred scenario 1 to scenario 2. This aversion to loss lies deep in our DNA. Perhaps it comes from the fact that losing something 5,000 years ago meant more than losing something today. The stakes were higher. Losing back then might mean you went hungry, your mate was kidnapped, or you lost your life. Maybe we will always be wired this way.

Consider another experiment. Read the following description below and give your answer:

An individual has been described by a neighbor as follows: “Steve is very shy and withdrawn, invariably helpful but with very little interest in people or in the world of reality. A meek and tidy soul, he has a need for order and structure, and a passion for detail.” Is Steve more likely to be a librarian or a farmer?

Nearly everyone who reads this description confidently concludes that Steve is more likely to be a librarian than a farmer. The problem with this conclusion is it omits an application of basic probabilities. After all, if I asked you how many male librarians there are to male farmers, your answer may change. If I told you that there are roughly 20 male farmers for every 1 male librarians, most would regret the conclusion they read after the above passage. Somehow our powerful brain lets us down. After all, it’s not that we don’t know there are likely many more male farmers than librarians but something goes wrong in the wiring. We incorrectly focus on a set of details not critical to the actual question we are facing. Is our brain taking a short cut? Do we simply fixate on the sensory details over mathematical ones because stories are more interesting to us? It’s hard to say what causes this but it’s clearly a sign of our cognitive inefficiencies.

These anecdotes are small glimpses of real-world examples showing the cognitive shortcomings built into our brains. Today, a new technology called fMRI is giving us more scientific access into how our mind reacts to different situations. In one trial, the electrodes that were capable of detecting which areas of the brain were stimulated revealed something amazing. In this simulation, a person was seated alone in a room with a computer. The subject was told their computer was linked to a series of other computers and that they would be playing a game of virtual throw and catch. When the ball was thrown to their computer screen they would press a button and throw it on to the other participants in this digital version of the game we all grew up playing. Then the experimenters changed something. Instead of receiving the ball in the normal sequence the subject had come to expect, the other computers began leaving the subject out of the rotation of playing catch. Recall, the subject was hooked up to fMRI. What the scan showed was a flurry of activity in an area which fires when humans experience physical pain like a broken arm. Being left out of a virtual game of catch is a small microcosm of the pain we feel when we are left out of something we care about—like making money in the late stages of a raging bull market.

All of these studies and others like it can be found in books written by the Godfathers of behavioral finance which include: Daniel Kahneman, Amos Tversky, Robert Shiller, Richard Thaler, Daniel Arielly, and James Montier. These brilliant minds have written extensively on the topic of human decision-making and have realized something that should be obvious: The human mind isn’t a perfectly rational machine. It has flaws, weaknesses, and blind spots. We are not always agents of reason and objectivity despite the fact that we have the most powerful supercomputer in the world between our ears.

It seems so blatant when you examine these situations when our brains let us down, yet so many people want you to believe the opposite. For basically the last sixty years, an increasing number of financial and economic courses have taught students that market participants are rational. Either this means all people are rational OR only the rational people participate in economic decisions and other more emotional actors stay out of these matters. I don’t know which one seems more preposterous. This “rational” decision making assumption isn’t contained to just the field of economics.

The entire field of finance, from academia to the practical investment, of assets has also been built on this principle of rationality. The Nobel Prize winning concept of Capital Asset Pricing Model, known more frequently as “CAPM” has been requisite curriculum for every student of finance since the 1950s. CAPM essentially assumes that the price of any security perfectly reflects its intrinsic value. Any potential mispricing instantly disappears as “rational” market participants quickly step in to either sell an overpriced asset or buy an underpriced one. In other words markets are efficient!

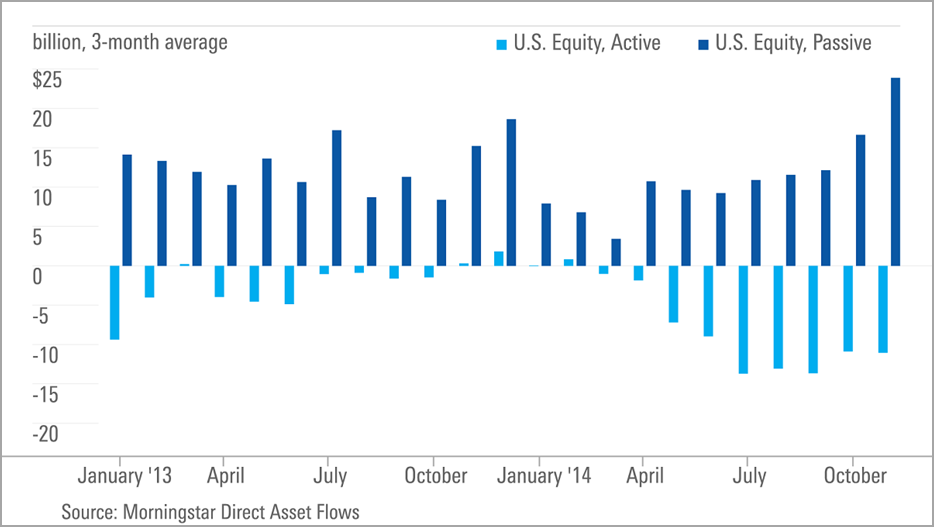

Let me walk you through how this moves from a college text and straight into an investor’s portfolio. A client enters a financial advisor’s office looking for some help managing their wealth. The advisor tells the client that the markets are really complicated and can’t be beat so the best thing you can do is minimize your costs and diversify your portfolio. If they weren’t motivated by money they would tell you to buy the S&P 500 ETF (exchange traded fund), a non-managed index tracker, and throw away the key. But this doesn’t make them any money. Instead, they tell investors that they need an advisor to rebalance their portfolio periodically and to hold their hand when markets get “choppy.” It’s this sales tactic that has helped fuel the tremendous flow from actively managed mutual funds to ETFs.

While it’s true that putting client assets into low-cost funds is a benefit, what’s rarely discussed is how ridiculous it is to charge a fee to rebalance and hand-hold a client during turbulent times. Rebalancing is a nearly brainless task that really doesn’t justify a fee. In fact, there are specific re-balancing funds that can do this automatically and in a very low-cost manner. Certain advisors do serve as pseudo psychologists but the data suggests that the majority of advisors cave to their client’s emotional impulses at market extremes. (Therefore, a disciplined system that will buy into selling frenzies or sell into buying manias can definitely enhance returns—IF clients and advisors stick with the program!)

The last time the overall stock market displayed enough volatility for an advisor to earn their stripes was during the financial crisis (the panic in nearly all things energy-related last year was a more sector-specific opportunity, though a highly lucrative one). Since then, the stock market has steadily climbed back to its all-time highs. Investors who’ve simply owned stocks and nothing else have done quite well. This rising-tide-lifts-all-boats environment for equities has made it difficult to separate skill from luck in the investment world. I frequently equate investing to farming. Sometimes you can do everything right and growing conditions don’t cooperate, making every farmer look foolish. Other times, the growing conditions are so good anyone could produce a bumper harvest. It really takes volatility, changing conditions, and, most importantly, time for skill to surface.

This idea that active management still works and that longer time-horizons lead to superior returns couldn’t be more out of vogue. Academics have been touting passive investing and advisors have figured out a way to sell it. The tombstone was already being engraved. It was going to read, “Here lies the grave of the active manager.” But in 2013, the Godfathers of behavioral struck back when Daniel Kahneman was awarded the first Nobel Prize in Economics to someone with no formal training as an economist. A social psychologist by trade, Kahneman, along with his now deceased research partner Amos Tversky, scoffed at the notion that our minds work like a computer, utilizing reason and objectivity for all decisions that require it.

Wall Street knows that investors aren’t rational and they build products and services to take advantage of these shortcomings. Recall the earlier story of the person’s brain activity rising when they were left out of the virtual game of catch? We hate feeling left out and the portion of our brain that is stimulated when we feel this way is the same as physical pain. Wall Street isn’t playing an innocent game of catch but it certainly knows how to exploit this feeling. The IPO darlings of Wall Street offer the perfect avenue. Brokerage firms tout the hot IPOs and are able to charge placement fees that investors must pay to reserve a spot in these deals. Investors gladly pay because hope springs eternal that every IPO is the next Amazon, Microsoft, or Google. This couldn’t be further from the truth. IPOs, three years after launch, underperform the overall stock market by 21% PER YEAR!!!!!

Another bias that Wall Street likes to exploit is our action bias. Recall the soccer goalie who doesn’t want to look like he didn’t try? Investors, too, like to at least think they can do something to boost their portfolios returns. Again, this couldn’t be further from the truth. Investors who are more active dramatically underperform those who are more patient. And while there are certainly times to be opportunistic as an investor, it’s far less often than you might suspect.

Henry Markram and others have decided to attempt the unimaginable. They want to understand the exact construction and processes of our brain down to a cellular level. He may not succeed but someone eventually will. When they do, science will help prove what many of us already suspect. The wiring of our brain, while astonishingly capable in so many ways, has serious limitations. Figuring out how these flaws, or evolutional inclinations, manifest in the investment world is a critical tool for any investor looking to make better decisions. Further, those individuals who’ve figured out how to capitalize on the inefficiencies of others can expect to do better than those who choose to ignore them. For years, Evergreen Gavekal have been researching these behaviors and investing in these concepts. We have woven techniques into our investment process that helps us detect when these biases are at work in the markets. New tools, analytics, and research will allow us to continue to develop the role our analysis of behavioral finance plays in the way we manage money. Although understanding the human brain is far from a completed science, it’s clearly headed in the direction of greater understanding of our mental strengths and weaknesses. We hope to be one of the firms who use this evolving knowledge to generate profits for our clients in what is likely to be a very return-challenged future.

*Technical note for soccer fanatics (including our eagle-eye EVA editor, Ian Tanner): This study counts missed kicks as saves, not just those instances where the goalie actually intercepted the ball.

Chief Executive Officer

To contact Tyler, email:

thay@evergreengavekal.com

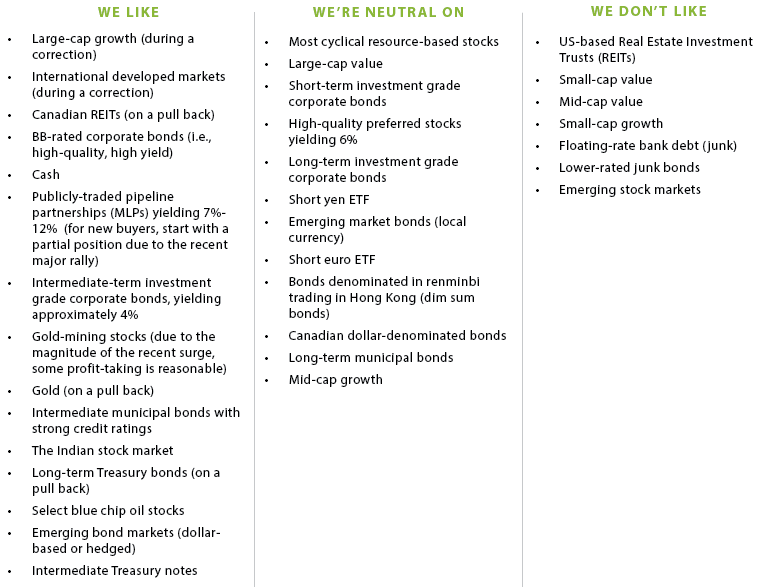

OUR LIKES/DISLIKES

No changes this week.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.