“Would higher inflation lead to stronger equity market returns? Here the answer is a simple no. History has shown time and again that accelerating inflation leads to lower P/Es, and vice versa.”

-LOUIS GAVE, founder Gavekal Research.

KJR. For younger Seattleites, the sequential letters K-J-R are synonymous with sports radio, 950 on your dial. But for all those EVA readers who came of age in the Seattle area during the ‘60s and ‘70s, KJR meant one thing: the best rock and roll radio station in the city. For the purposes of this EVA, KJR stands for something entirely different—as in, Knee-Jerk Reaction—and it is for sure a force that has been rocking and rolling the financial markets in recent weeks.

In the behavioral sense of the phrase (versus the patellar reflex to your doctor’s tap), this KJR can be defined as an emotional rather than analytical response to an event or experience. Since Donald Trump was elected three weeks ago, there has been a whole lot of knee-jerk reacting going on in nearly every corner of the investment world. Safety and income are out, while stocks exposed to a presumed inflationary boom are in—with little thought given to realities such as the disinflationary drag from a rocketing dollar.

This month’s Guest EVA edition is meant to offer the opposite of the KJR response to one of the most surprising presidential election outcomes since Truman beat Dewey.

No financial asset class has been rocked harder by Mr. Trump’s win than have bonds, a fact we’ve noted in our post-election EVAs. Consequently, it has become commonplace to hear funeral dirges for the 35-year bull market in bonds. Treasury rates peaked at nearly 16% in 1981 and have made a series of lower highs, and lower lows, in yield terms ever since. They troughed in July of this year at 1.3% and 2.1% for the 10-year T-note and the 30-year T-bond, respectively, in the wake of the UK’s vote to leave the European Union. This week, they are nearing 2 ½% on the 10-year and are north of 3% on the 30-year.

Therefore, perhaps the growing army of bond bears is right. Maybe Trumponomics is the death-knell for this incredible shrinkage of interest rates and our recent EVAs have considered that possibility. Should longer treasury rates move up to the 4% range, likely pushing investment-grade corporate bond yields close to 6%, that would be great news for pension plans, insurance companies, and retired investors—at least for future cash flows. The immediate impact on their portfolios, however, is an entirely different story.

A rate spike of that magnitude certainly won’t be pain-free when it comes to market values. It will be interesting to see how serenely income investors take the “statement shock” of marked-down prices. The early evidence isn’t encouraging, which shouldn’t be surprising based on the panic-stricken reaction to the “Taper Tantrum” in the summer of 2013.

As noted above, there’s already been considerable damage done to bonds, particularly in the US where growth expectations have gone from subdued to borderline euphoric, with attendant assumptions of roaring inflation and multi-trillion dollar annual deficits (the former being particularly bond-unfriendly). As a result, millions of investors are wondering how much worse it’s going to get in the yield world. Therefore, I thought it would be helpful to run a couple of brief commentaries from two of the most influential bond investors known to humanity.

Bill Gross has long been regarded as the Bond King even though his crown has been usurped in recent years by Jeffrey Gundlach, at least in the minds of many in the financial media. While Mr. Gross worked his magic at Pimco, his Total Return Fund grew exponentially, for a time becoming the world’s biggest bond fund, with assets peaking at nearly $300 billion in early 2013. During this era, it was hard to turn on CNBC without seeing Mr. Gross pontificating on the Fed, bonds, and, much less successfully, stocks.

After a rough performance stretch and a much-publicized falling out with Pimco management, Mr. Gross jumped ship to Janus. He now manages a mere fraction of his old fund’s asset base yet his opinions are still highly sought-after and valued. In his very short note, he makes the case for why he believes the stock market’s embrace of Mr. Trump is ill-advised. Frankly, I disagree with some of his darker points. This is despite my concurrence with his basic thesis that portions of the stock market are far too optimistic about growth prospects over the next couple of years.

More in line with my thinking is the November Interim Update and Comment from Dr. Lacy Hunt and Van Hoisington. Although Dr. Hunt is not quite on the same super-star plane as Bill Gross, he’s close. His Austin, Texas-based firm, Hoisington Investment Management, has nearly doubled the return of the main bond benchmark, the Barclays Aggregate Index, over the past ten years (it is also comfortably ahead of the stock market in that time-frame and since the dawn of the new millennium, with, of course, much less risk).

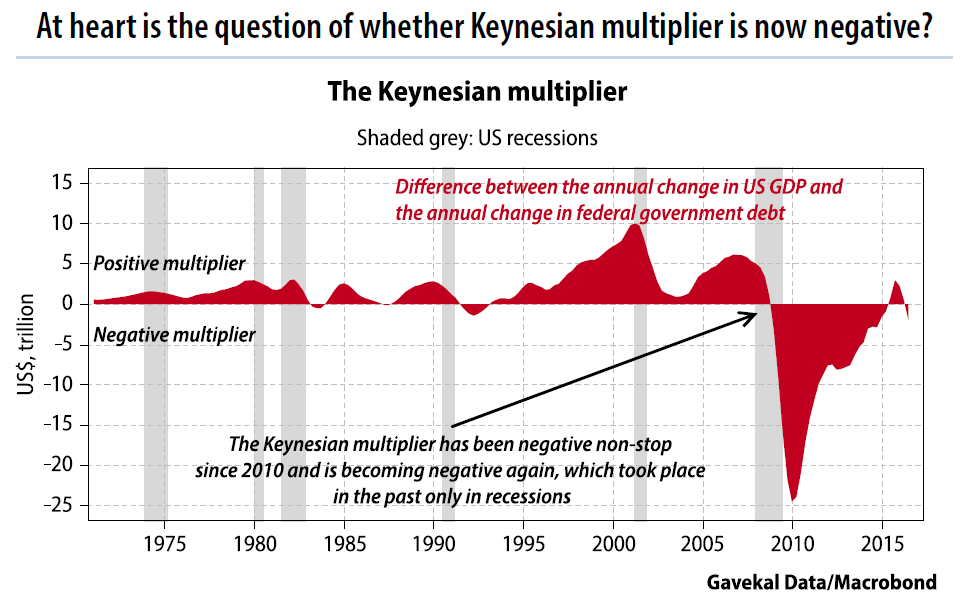

In addition to being a member of Hoisington’s Strategic Investment Management Committee, Dr. Hunt has gained wide acclaim for his outstanding economic forecasting record. He has long argued that the ultimate drag on growth is the planet’s massive debt overhang. He notes, for example, that over the 12 months ended 9/30/16, the US household, business, and government sectors combined added $2.2 trillion of debt. Yet, overall GDP increased by just $450 billion. In his view—and Evergreen’s—we are clearly pushing on a debt string. Our partners at Gavekal are picking up on the same reality.

Reinforcing this point is the following chart from another crack economist, David Rosenberg. As you can see, higher debt levels have consistently been associated with slower growth.

DEBT-TO-GDP VERSUS ECONOMIC GROWTH

Yet, our president-elect is proposing to pile on trillions more IOUs, seeking to solve a debt problem with more debt. The optimistic view is that if this is used to finance infrastructure the growth benefits will out-weigh the costs. However, China is on track to spend $500 billion this year alone on its latest fixed asset splurge, dwarfing Mr. Trump’s planned infrastructure outlays averaging $100 billion per year. Despite this, China’s growth continues sluggish by its standards, even based on the highly questionable official figures. Moreover, Japan’s experience of the last twenty-five years—characterized by enormous deficits and unbridled spending on “bridges to nowhere”—certainly doesn’t indicate this approach is a panacea.

As Dr. Hunt and Mr. Hoisington point out, the investment community was convinced back in 2009 that the combination of the Obama administration’s $800 billion stimulus plan and the Fed’s initial trillion dollar quantitative easing (i.e., money fabrication) would produce an inflationary boom. Instead, inflation has been consistently below expectations and the US economy has endured its weakest post-WWII expansion.

The financial markets are certainly totally convinced this time will be different. But don’t forget that those last five words have historically been extremely costly. Investors buying into the theory of an overnight Trump-driven boom may wind up getting cut off at the knees—and that’s a lot more painful than your doctor’s gentle tendon-tap.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

By Bill Gross

The Trumpian Fox has entered the Populist Henhouse, not so much by stealth but as a result of Middle America’s misinterpretation of what will make America great again. Not having voted for either establishment party’s candidate, I write in amazed, almost amused bewilderment at what American voters have done to themselves. A Reuters/Ipsos Election Day Survey of 10,000 voters revealed the extraordinary fury of the American populist movement. Almost 72% agreed that “the American economy is rigged to the advantage of the rich and powerful”. Count me among them, yet in voting to deny Hillary Clinton the Henhouse, they “unwittingly” (lack of wit), let Donald Trump sneak in the side door. His tenure will be a short four years but is likely to be a damaging one for jobless and low-wage American voters. They were the force for Trump’s flipping the Midwest into a Republican Electoral College victory. But while the Fox promised jobs and to make America great again, his policies of greater defense and infrastructure spending combined with lower corporate taxes to invigorate the private sector continue to favor capital versus labor, markets versus wages, and is a continuation of the status quo.

For example, Republican pleas for tax reform are centered around the argument that America has one of the highest corporate tax rates in the world at 35%. Not so. Of the S&P 500’s largest 50 corporations, the average tax rate (including state, local and foreign regulations) is 24%. U.S. corporations rank among the world’s most lightly, as opposed to heavily, taxed. Trump policies also appear to favor the repatriation of trillions of dollars of foreign profits at extremely low cost under the logic that the money will be spent for investment here in the U.S. Doubtful. The last time such a “pardon” was put into law in 2004, no noticeable pickup in investment took place. Of the $362 billion that earned a “tax holiday”, most went to dividends, corporate bonuses, and stock buybacks. Apple or any other large U.S. corporation can borrow the money they need here in the U.S. at historically low interest rates to fund investment. A few have, but over $500 billion annually in recent years has gone to the repurchase of corporate stock and the increase of earnings per share, instead of earnings and GDP growth. Why would they need to repatriate anything for investment in the real economy?

But could a Clinton Administration have done much better? Probably not. Both the Clinton Democrats and almost all Republicans represent the corporate status quo that favors markets versus wages; Wall Street versus Main Street. That’s why the American public and indeed global citizens will continually take a wrong turn in their efforts to neuter the establishment and to regain several decades’ lost momentum in real wages versus real profits. Neither party as they now stand has bold policies beyond the reach of K Street Lobbyists. To my mind, there are better solutions than either party’s election platform, such as a Keynesian/FDR job corps or a Kennedyesque AmeriCorps that puts people to work helping other people. Such programs were never emphasized by either candidate. Let’s supplement welfare with a patriotic “Help America” jobs program, even if government organized. Would it be as efficient as a corporate-led effort? Of course not, but corporations are fighting structural headwinds, such as demographic aging, technological displacement of jobs (robotization), deglobalization, and overleveraged balance sheets. They focus on the bottom line as opposed to the public welfare. Government must step in, not by reducing taxes, which will only increase profits at the expense of labor, but by being the employer of last resort in hopefully a productive way.

Populism is on the march and a Trump victory will do little to halt its advance in future decades. If anything, it is demographically baked in the cake. Investors, as The Economist astutely pointed out, face a possible no-win situation. Unless the worker’s share of GDP reverses its downward trend, and capital’s share peaks, then populists worldwide will reject establishment parties in almost every future election – initiating in some cases growth-negative policies revolving around trade, immigration, and yes, in Trump’s case, lower taxation that may lower GDP growth, not raise it. Global populism is the wave of the future, but it has taken a wrong turn in America. Investors must drive with caution, understanding that higher deficits resulting from lower taxes raise interest rates and inflation, which in turn have the potential to produce lower earnings and P/E ratios. There is no new Trump bull market in the offing. Be satisfied with 3-5% globally diversified returns. The Wall Street, finance-led hegemon is fading. The Populist sunrise has barely broken the horizon.

By Van Hoisington and Lacy Hunt

The outcome of the national election does not change our view on the trajectory of the economy for the next four to six quarters. Markets are repricing because of the assumption that lower taxes, less regulation and higher deficit spending will provide a positive demand shock, followed by a surge in inflation.

The most potentially dynamic component of the Trump plan is the reduction in tax rates. The plan calls for a $500 billion decrease in taxes over the next ten years. With a tax multiplier of –2, there would be a lift in economic growth of $1 trillion over the next ten years for an economy that is on a growth path of about $5 trillion over that same time frame. As such the annual growth could be boosted from $500 billion a year to $600 billion. This stimulus will take a considerable amount of time to work through the economy and the positive contribution requires that monetary conditions remain favorable, not adversarial.

The Reagan tax cuts of the early 1980s are quite instructive on this point. That tax cut was far larger in relative terms than what is being proposed, and since the federal debt was so much less than it is currently, the tax multiplier was more negative, approximating –3. Additionally, the Reagan tax cuts were being implemented while interest rates were falling sharply. Even with fiscal and monetary conditions working in tandem, the economy was very slow to respond. The Republicans lost control of the US Senate in the 1984 Congressional elections and their numbers in the House were reduced. Also, Fed Chairman Volcker was required to orchestrate a major decline in the dollar under the Plaza Accord of 1985 and interest rates did not reach their cyclical low until 1986.

Additionally, initial conditions (which is an economics term for all the other factors that influence economic growth) are negative and have become more negative recently. The economy is extremely overindebted, turning even more so this year. In the latest statistical year, debt of the four main domestic nonfinancial sectors increased by $2.2 trillion while GDP gained only $450 billion. Debt of these four sectors (household, business, Federal and state/local) surged to a new high relative to GDP. This will serve as a restraint on growth for years to come. Also, the economy is in an expansion that is 6 1/2 years old. This means that pentup demand for virtually all big ticket items is exhausted – apartments, single family homes, new vehicles, and plant and equipment. Rents are falling as a result of a massive apartment construction boom. Reflecting a huge stock of new vehicles and significant easing of credit standards, the auto market appears saturated. Vehicle sales for the first ten months of this year have fallen slightly below last year’s sales pace. New and used car prices are down 1.2% over the past year. The residential housing market appears to have topped out even before the sharp recent advance in mortgage yields, which will place downward pressure on this market.

The recent rise in market interest rates will place downward pressure on the velocity of money (V) and also the rate of growth in the money supply (M). This is not a powerful effect, but it is a negative one. Some additional saving or less spending will occur, thus giving V a push downward. So, in effect, the markets have tightened monetary conditions without the Fed acting. If the Fed raises rates in December, this will place some additional downward pressure on both M and V, and hence on nominal GDP. Thus, the markets have reduced the timeliness and potential success of the coming tax reductions.

Another negative initial condition is that the dollar has risen this year, currently trading close to the 13year high. The highly relevant Chinese yuan has slumped to a seven year low. These events will force disinflationary, if not deflationary forces into the US economy. Corporate profits, which had already fallen back to 2011 levels, will be reduced due to several considerations. Pricing power will be reduced, domestic and international market share will be lost and profits of overseas subs will be reduced by currency conversion. Corporate profits on overseas operations will be reduced, but with demand weak and current profits under downward pressure, the repatriated earnings are likely to go into financial rather than physical investment.

The psychological reaction to Trump’s unexpected victory, along with the worsening initial conditions, means that the upcoming tax package may do little more than contain the additional negative momentum developing within the economy. Additional deficit spending for infrastructure also carries a negative multiplier. This is confirmed by recent scholarly research. Let’s say, for the purpose of argument, that the multiplier is a small positive. It will take a long time to develop the preliminary engineering and design work to identify the projects and even longer to hire the contractors. So even if the multiplier were not negative, the benefit seems to be well into the future.

Markets have a pronounced tendency to rush to judgment when policy changes occur. When the Obama stimulus of 2009 was announced, the presumption was that it would lead to an inflationary boom. Similarly, the unveiling of QE1 raised expectations of a runaway inflation. Yet, neither happened. The economics are not different now. Under present conditions, it is our judgment that the declining secular trend in Treasury bond yields remains intact.

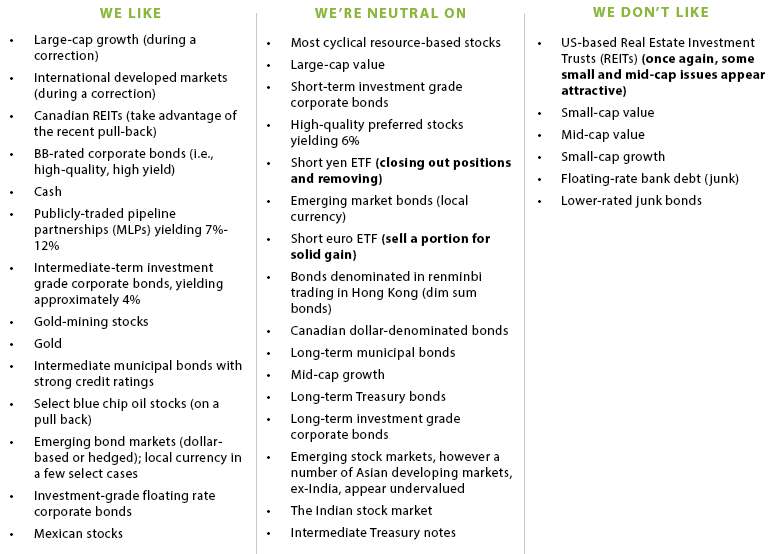

OUR CURRENT LIKES AND DISLIKES

Changes are bolded below.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.