“Ahhh, Maggie, in the world of advertising, there’s no such thing as a lie. There is only expedient exaggeration.”

-Cary Grant, playing Roger Thornhill, in Alfred Hitchcock’s North By Northwest.

“When it becomes serious, you have to lie.”

-Jean Claude Juncker, in April, 2011, one of the most senior eurozone officials at the time.

“The Fed is an agent of distortion. They have their fingers, their thumbs, on the scales of finance.”

-Jim Grant, author of Grant’s Interest Rate Observer.

Special message: As a reminder to readers, Grant Williams, author of this month’s guest EVA, will be speaking Tuesday night at Evergreen’s Annual Outlook event, along with Louis Gave, co-founder of world renowned research firm, GaveKal Dragonomics.

The event is full, but we may have cancellations over the weekend. If you would like to receive more details and get on a waiting list to attend, please reply to this email with your full name.

The hilarity of polarity. One of the advantages of being on vacation for two weeks, which I did earlier this month, is the ability to gain some perspective. In my case, this is true, even though I typically spend half of my away-time working (I realize some of you might not consider reading research on a beach in Hawaii to be real work, but my wife sure does!). Yet, despite my best efforts to stay current, certain newspapers, and other materials, were put aside until the long plane ride home.

It was actually quite humorous to read the panicky articles and essays from early February on a ten-day delayed basis. This, of course, was after a rambunctious rally that brought the S&P 500 right back up, close to its all time high set in January. It was incredible to read articles published just a bit over a week apart, where the attitudes had shifted so dramatically. The dominant feeling that hit me, as I thought about this radical reversal, was how bipolar market moods are these days. This is a notable change from the last couple of years when emotions pretty much ran one way, as in bullish.

The flow of sentiment from the more recent commentaries seemed to be that the mid-January to early-February swoon was just a minor blip, the proverbial “healthy” correction. EVA readers may recall that we speculated the turbulence at the time would probably be a passing phase and, remarkably, we got that one right. However, we further opined that it was also likely the equivalent of a movie trailer for coming attractions.

Consistent with the prevailing mood that the storm has passed, at least as I write these words, is the belief that the fundamental underpinnings of both the US stock market and the global economy are just dandy. Of course, you won’t be surprised to learn that we beg to differ (sorry, I know begging’s not attractive for a man my age, but I’ve heard it pays very well, at least on the off-ramps around Bellevue).

To reinforce some of our persistent concerns, we’re bringing out the heavy artillery this week by running Grant Williams’ February 10 edition of his Things That Make You Go Hmmm (once again, apologies to those who have already read it but, then again, it might be worth a quick re-perusal).

Grant’s newsletter has literally “gone viral” over the last couple of years and is now published by Mauldin Economics, where it has become one of their most popular communications. (To be included among this astute cohort at no charge, please click here).

As Grant points out, we are going through the late stages of an era when market-movers have come to believe that the Fed has the situation under control. The devastation that has afflicted many emerging markets is one strident indication that this is definitely not the case (though we acknowledge there are numerous factors weighing on the developing world currently). His factoid on the Brazilian currency ETF is shocking, even to our minds, which are rarely surprised by the lunacy of the blundering thundering herd. Grant also includes a brief comment from GaveKal’s co-founder Anatole Kaletsky. Anatole tends to be much more charitably inclined toward the Fed and its policies than we are; however, even he notes that the truthfulness of central bankers increasingly resembles that of Madison Avenue, although perhaps not quite as credible.

Overall, there is plenty in here to cause those who believe this heavily Fed-fertilized tree can continue growing to the sky might want to check out how healthy the root system is. As arborists well know, trees that grow easily tend to fall over the same way.

THINGS THAT MAKE YOU GO HMMM

The End of the Innocence, February 10, 2014

Grant Williams

Take a long, hard look, Janet.

The landscape over which you cast your eyes when you accepted the poisoned chalice prestigious role of Fed Chair changed last week—just two days before you were confirmed in a rather lovely ceremony.

Across the world, emerging markets are suffering from the Fed’s unilateral declaration that it’s every man (“And woman!”—Sorry, Janet, “and woman”) for him- or herself.

In Brazil, as The Economist points out this week, the timing couldn’t have been worse:

(Economist): Later this month [Dilma Rousseff] will launch her campaign to win a second term in a presidential election due on October 5th. Normally at this stage of the political cycle, as in the run-up to elections in 2006 and 2010, the government would be ramping up spending. But when Ms. Rousseff spoke to the World Economic Forum in Davos last month, with the São Paulo stock market and the real dipping along with other emerging economies, she felt impelled to stress her commitment to being strait-laced.

So far so predictable:

Brazil’s economy has disappointed since she took office in January 2011. Growth has averaged just 1.8% a year; inflation has

been around 6%; and the current-account deficit has ballooned, to 3.7% of GDP. Her government has some good excuses. She

inherited an overheating economy, the world has grown sluggishly, and cheap money in the United States and Europe prompted

an exaggerated appreciation of the real.

So, tepid growth, persistent inflation, and a painfully strong currency. What could POSSIBLY have caused that situation, I wonder?

But Ms. Rousseff has scored some own goals as well. Her predecessor, Luiz Inácio Lula da Silva, left monetary policy to the

Central Bank and mostly stuck to clear fiscal targets. By contrast, Ms Rousseff chivvied the bank into slashing interest rates; her

officials tried to micromanage investment decisions with subsidies and to cover up the fiscal damage through accounting

tricks. Rather than the promised recovery of growth, the result was that Brazilian businessmen and foreign investors lost

confidence in the economic team—and just at the wrong time. When America’s Federal Reserve last year announced a possible

“tapering” of its bond-buying, the real began to slide. Against the dollar, it is now 17% below its value in May.

Stick around, here comes the rub:

A weaker currency is just what Brazil needs if it is to balance its external accounts and its manufacturers are to thrive. But it also

risks adding to inflation, the upward creep of which was one factor (along with poor public services) in mass protests that shook

Ms Rousseff’s government last year. This has prompted a change of mind. Alexandre Tombini, the Central Bank governor, has

been allowed to raise interest rates (from 7.25% to 10.5%).

Rising rates. We know a word for that, don’t we boys and girls? It begins with T and rhymes with frightening.

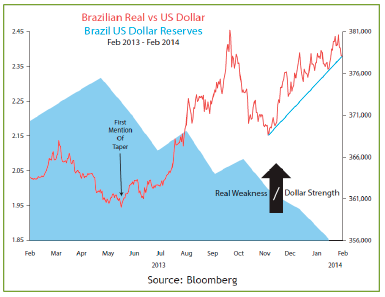

And here (see chart on next page), in all its glory, is the Brazilian real versus the US dollar, alongside the reserves of the Banco Central do Brasil (with a couple of milestones added for clarity):

To defend their ailing currency, the Brazilian central bank has had to prop up the real and, finally, to raise interest rates to try and stem the outflows and dampen inflation, just as GDP turns negative on a Q0Q basis and falls below 2% annually—hardly the kind of number the world has come to expect from a member of the BRICs.

Perfect.

The results of this shift in Brazilian viability have shown up in some rather surprising places as return-seeking investors who piled into “Brazil” through a real-denominated ETF suddenly decided that the currency, which had been steadily weakening for months, had apparently passed the point of no return:

(Bloomberg): The WisdomTree Brazilian Real Fund (BZF), an exchange-traded fund tracking Brazil’s currency, lost more than 90

percent of its assets this week after redemptions of $473 million.

The fund, which had $513 million under management as of Jan. 24, lost the assets on Jan. 28 and 29, according to data compiled

by Bloomberg and the latest fund data from New York-based WisdomTree Investments Inc.... It’s the only U.S.-registered ETF that follows the real, which fell to a five-month low on Jan. 29.

Data posted on WisdomTree’s website show the fund received an inflow of more than $500 million on Oct. 10. Brazil’s currency

has depreciated 9.6% since then, the second most among major currencies tracked by Bloomberg.

I’ve said it before and I’ll say it again: Nothing matters to anybody until it matters to everybody—and by then it’s too late.

Everywhere you look, concern is rising amongst those charged with applying the copious amounts of sticking plaster that are vital to ensuring the world financial system doesn’t fall apart; and so, a couple of days after Rajan delivered his incendiary comments, IMF head Christine Lagarde was wheeled out to try and get the kids to play nice in the sandbox again:

(WSJ): The head of the International Monetary Fund on Monday called for greater collaboration among the world’s central

banks, citing the threat of turmoil spreading through the global financial system.

Global stakeholders must take “collective responsibility for managing the complex channels of the hyperconnected world,” IMF

managing director Christine Lagarde said in a speech prepared for the Richard Dimbleby Lecture in London.

That translates into “all monetary institutions cooperating closely—mindful of the potential impacts of their policies on others,”

she said....

Ms. Lagarde said the proliferation of global financial and trade linkages over the past decade, combined with the emergence of

the major developing economies, requires greater global collaboration. She called it “a new multilateralism.”

“In such an interwoven labyrinth, even the tiniest tensions can be amplified, echoing and reverberating across the world—

often in an instant, often with unpredictable twists and turns,” she said.

“The channels that bring convergence can also bring contagion,” she added.

Best of luck with that, Christine. It’s every “man” for himself now; and a big problem is that, over the course of the ongoing financial crisis (yes, it is), the power wielded by central bankers has reached unprecedented levels as one extraordinary measure after another has been implemented simply in order to maintain the status quo.

Not only that, but the emerging-market countries that have seen strong inflows as the Fed’s QE program sent billions of dollars their way in search of returns, are now in a bit of a fix, as the chart below demonstrates:

Jeremy Warner tackled the subject earlier this week, and his comments resonate:

(UK Daily Telegraph): More or less everywhere, from Britain to America and Japan, and from Nigeria to India and Europe, central

bankers have become the first, second, third and last line of defence for almost every economic problem that arises.

In Japan, the central bank has been ordered to print money until deflation is finally exorcised; Shinzo Abe’s second and third

arrows of economic rebirth—fiscal and structural reform—are meanwhile fast running into the sand, leaving the promised

return to decent levels of nominal GDP growth entirely reliant on whatever further actions the central bank can conjure up.

In America, they’ve had money printing, credit easing and just about everything else the central bank armoury has to offer, but

are now finding it impossible to rid themselves of the addiction.

Already Federal Reserve tapering has prompted financial chaos in the developing world, while new data announced on Monday

suggest that easing back on the monetary accelerator is once again causing the domestic economy to lose steam. Engage in

quantitative easing, and the economy grows; start to turn off the printing press and the economy slows to stall speed.

In the end, central banks can offer no more than sticking-plaster solutions, yet both the power and the expectation vested in

them grows by the day.

Precisely, Jeremy.

The great Anatole Kaletsky put his own twist on the problems facing central bankers on the eve of Ben Bernanke’s last day in office; and in doing so, not only did he hit the nail squarely on the head, he also laid bare a truth that far too many people are happy to willfully ignore:

(Anatole Kaletsky): Federal Reserve Chairman Ben Bernanke, who retires this week as the world’s most powerful central banker,

cannot be trusted.

Neither can Janet Yellen, who will succeed him this weekend at the Federal Reserve.

And neither can Mark Carney, governor of the Bank of England; Mario Draghi, president of the European Central Bank, or any of

their counterparts at the central banks of Turkey, Argentina, Ukraine and so on.

I am not trying to aim a valedictory insult at Bernanke or his central banking colleagues. On the contrary, I am drawing attention

to the skill and determination required by central bankers to perform one of the world’s most demanding and important jobs.

For just as James Bond has a “License to Kill” in the Ian Fleming books, so central bankers possess a “License to Lie”—or, putting

it more diplomatically and politely, to make promises about the future that cannot be honored and often turn to be false.

Nobody ever blamed a central banker for promising to support the currency and then suddenly allowing a massive devaluation,

as happened in Argentina last week and may soon happen in Turkey, Ukraine, Russia and many other emerging markets.

To mislead investors is actually a key skill required by a central banker’s job description. Revealing the true state of national

finances at a time when a devaluation or comparable financial crisis is looming might be to guarantee the loss of the central

bank’s entire reserves.

Yes, folks, central bankers lie. The job demands it. That means that they join politicians in the category marked “cannot be trusted,” and yet investors the world over are not only relying on the promises made by these individuals but also trusting them to be both transparent and honest when the job demands they be neither.

Given that they lie to us, and given that they are making two key representations to us, should we not perhaps take a moment to think about the two inputs to this particular equation?

Politicians across the globe are assuring us that (amongst other lies things):

1) The “recovery” is either here or right around the corner.

In fact, it is neither.

2) Remaining in the EU is the best option for Greece, Spain, Italy (and France).

It is not.

3) Soaking the rich is the answer to a multitude of problems.

It isn’t.

4) Raising taxes will generate the necessary revenue without having a negative effect on the economy.

It won’t.

5) Future promises of entitlement payments are solid.

They aren’t. Defaults are inevitable.

Meanwhile, the central bankers of the world are promising us that:

1) Interest rates will remain low for a very long time.

In the end, it’s not central bankers’ choice to make.

2) Quantitative easing has no ill effects and can be withdrawn at will without causing any problems.

It can’t be.

3) Printing money will not translate into higher inflation.

It will. It just hasn’t yet.

4) They will do “whatever it takes,” and that will be enough.

There is a limit to what they can do, and it will ultimately not be enough.

5) They are all in this together.

They’re not. It is every man for himself now, and the Fed will screw them all.

So here we are.

Having established that, like politicians, central bankers are required to lie to us in order to be able to do their jobs, we are left facing a couple of crucial questions. First, IS tapering tightening, or not? Secondly, what does all this chaos in emerging markets in the wake of The Tighten Taper mean, and where does it take us from here?

Fortunately, the great Albert Edwards of Soc Gen fame took the words right out of my mouth this week:

(Albert Edwards): Tapering is tightening, which inevitably ends in recession, bailout and tears. Our warnings throughout last

year that an unraveling of emerging markets (EM) was the final tweet of the canary in the coal mine have still not been taken

on board. The ongoing EM debacle will be less contained than sub-prime ultimately proved to be.

The simple fact is that US and global profits growth has now reached a tipping point and the unfolding EM crisis will push global

profits and thereafter the global economy back into deep recession. Our thesis on how EM would be pushed to crisis was simple,

especially as we saw close parallels with the 1997 Emerging Asia currency crisis.

We saw yen weakness further undermining an already weak balance of payments situation in the emerging world as a direct

replay of 1997. A strong dollar/weak yen environment is typically an incendiary combination for EM, and so it has proved once

again. Having reached tipping point the yen will often rally strongly as it has now and as it did in May 1997. This may or may not

delay the impending EM implosion for a few weeks. Indeed the Thai Baht, the first domino to fall in the Asian crisis, briefly rallied

strongly (vs the US$) in early June 1997, reassuring investors just ahead of its ultimate collapse.

There has never been any shadow of doubt in my mind that tapering = tightening, and I marvel that the Fed convinced anyone

otherwise. A Fed tightening cycle inevitably plays a key role in triggering the next crisis (see below). Plus ça change, hey?

1970 Recession/Penn Central Railroad

1974 Recession/Franklin National Bank

1980 Recession/First Penn/Latin America

1984 Continental Illinois Bank

1987 Black Monday

1990 Recession/S&L and banking crisis

1997 Asian currency collapse/Russian default/LTCM

2007 The Great Recession/Collapse of almost the entire global financial system

2014 Emerging Market collapse/deflation/recession/another banking collapse etc.

Albert is right, of course. Not only is tapering most definitely tightening (don’t listen to what they say, watch the results), but we have likely seen just the beginning of the fallout from the Fed’s new course.

Will they stick to it? No. They won’t be able to. They MAY taper another $10 bn in March when Janet Yellen’s first rate decision is announced, but I suspect that by then markets will be in such a state of disrepair that excuses will be made as to why the taper has been suspended. You can bet your bottom dollar that there will be some frantic calls put in to Ms. Yellen’s office by her peers around the world between now and March 20, all of which will be begging calling for an end to The Taper.

Ultimately, QE will continue to be expanded until it implodes in a fireball the like of which has never been seen before. There’s no choice, I am afraid, because the alternative would involve the telling of some very harsh truths by politicians and central bankers and the bestowing of some serious pain on an electorate that already holds them in contempt.

Think those truths are going to be volunteered?

Me neither.

The splintering of central bank policy is just the beginning.

This is the end of the innocence.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.