Implausible Deniability?

The economic and geopolitical headwinds are blowing much stronger than they were prior to Russia’s attack on Ukraine. So, what has been the stock market’s reaction to this? Just like in the days when the Fed was in binge-print mode, it has been to head north. The S&P 500 and the Nasdaq are up roughly 4% and 5%, respectively, since Putin’s ill-advised incursion.

Bull markets are supposed to climb walls of worry, but this ascent is worthy of Spider-Man. Consider the list of negatives that have intensified since the invasion:

As I’ve previously admitted, the forgoing obstacles have been sufficient to warrant my backing away from the “inflationary boom” scenario I have often discussed. This is despite my belief that many areas of the U.S. economy are poised to perform very well. Energy, agriculture, defense, and capital spending beneficiaries are prime examples, as I’ve written recently. However, the kind of broad-based economic surge I was anticipating later this year seems to me more possible than probable when factoring in all of the above.

Focusing on treasuries, the rate rise this year has been remarkable. The 10-year T-note is now up a full 1% (100 basis points in bond market lingo). That’s a 66% increase, and from the yield trough in the summer of 2020 it’s been a quintuple, from 0.5% to 2.5%. While it’s true that percentage increases off extremely low-rate levels can overstate the move, it nevertheless constitutes a material rise in the cost of money. Of course, real, or inflation-adjusted, yields remain deeply negative. Accordingly, one could argue that monetary policy is still highly stimulative — and inflationary. Actually, you’d get no argument from me on that score.

It remains my view that the real economy can cope with these higher rates, but I’m not so sure about the financial markets. There are already margin call problems flaring up, mostly related to commodities. Additionally, rumors are floating around about a major U.S. bank being in trouble. Hedge funds are notorious for using extreme leverage in trying to goose low yields. These “strategies” can blow up when rates rise sharply, triggering a further proliferation of margin calls. The interconnected nature of this segment of what is known as “the shadow banking system” can cause convulsions in a few funds to rapidly go viral.

Moving on to energy, the widespread fears that surfaced earlier this month when oil first pierced the $100 mark have largely subsided. In fact, the powerful snapback in tech stocks despite oil shooting well north of $100 again and the spike by interest rates is somewhat of a head-scratcher. Both of these negatives are unlikely to meaningfully reverse anytime soon but, again, there seems to be a no-worries attitude on the Street, as has been the case for the last 23 months (i.e., since the pandemic panic subsided).

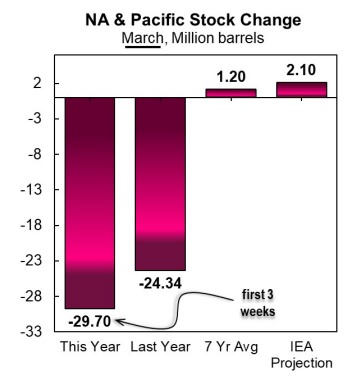

A major part of the cavalier attitude toward what I’ve been calling “The Third Energy Crisis” has been due to abysmally poor supply-and-demand reports on oil from the International Energy Administration (IEA). The IEA’s data is still heavily relied upon by governments and even large institutional investors. Yet it has been drastically understating demand — and, to a lesser degree, overstating supply — for nearly a decade. This amounted to roughly a 2.7-billion-barrel undercounting, a flaw the IEA has allowed to persist year after year — and is again in 2022. Early this year, it quietly revised its number by 1.9 billion barrels, which leaves it now “just” 600 million barrels off the mark.

Fortunately, our friends at Cornerstone Analytics have been shining a bright light on this for almost as many years as the IEA has been putting out its absurd numbers. In fact, this is such a travesty that I will be devoting a full EVA to this subject in the near future. On the unfortunate side, the very same IEA believes sanctions against Russia will lead to a further 2-3-million bpd supply shortfall. I believe it could be even worse, though I hope I’m wrong. Going into 2022, crude inventories were already perilously low. As the first quarter winds down, it appears there is another deep stock draw occurring. Once more, the IEA is nowhere in the vicinity of accurate.

Natural gas prices in Europe and Asia have been even more astounding. At one point this winter, natural gas on the Continent was trading at the oil equivalent of roughly $300/barrel. Prices for the blue fuel have also gone postal in China, just as they have for coal.

Because energy filters through to such a wide range of goods, this is a powerful force pushing inflation even higher. One indirect example is with food prices, where soaring natural gas is aggravating shortages caused by the loss of wheat and corn exports from Ukraine and Russia, major exporters of both products. (Nat gas is a critical fertilizer feedstock.)

Diesel prices have already surged to the point that they are posing serious problems for the trucking industry. Because moving freight cost-effectively is such an essential aspect of a healthy economy this is a significant — and, in my view, significantly underappreciated — threat. Due to the potential for shockingly low oil stockpiles later this year, credible observers feel crude could hit $200. Obviously, a stock market back near its highs is not remotely factoring in this nontrivial risk. One could quip that investors are once again proving that “denial” is not just a river in Egypt. Accordingly, I’m calling this a bear market rally, particularly in tech stocks. If you’re a large holder of those, I’d be seriously lightening up now, at least with the very high P/E names (i.e., the COPS — Crazy Over-Priced Stocks). On that point, this newsletter has given some timely negative calls on the meme stocks and the two poster kids of that mania have had monster rallies this week. In my view, this leaves them highly exposed to another one of the sickening swoons they have performed multiple times over the last year. To conclude on a parting quip, I’m very much of the view that this "game stopped" being a money-maker for the Robinhood/Reddit crowd many months ago.

Positioning Recommendations

LIKE

To expand on last week’s brief mention, for those of you have read Chapter 17 of Bubble 3.0, you are aware that one of my strongest recommendations to protect against high and sticky inflation is the Swiss franc. (If you haven’t read it yet, it’s being sent out today and it’s been up on the Substack website for the last two weeks.) The flight to perceived safety by the dollar since the invasion has pushed the “Swissie” down a bit more. Because I believe this decade is destined to turn out a lot like the 1970s, as I’ve often written, I also believe the Swiss franc is a must-include for high-net-worth Americans who share my dollar-debasement concerns. Back in the Disco Decade, it rose by 170% versus the greenback.

NEUTRAL

Based on the global market stock market rally, despite the threats outlined in the introduction section, I’d hold off on accumulating(or even trim back somewhat) on the below equity categories.

DISLIKE

The Indian market has rallied back about 10%. In my view, this is another shorting opportunity with it trading at 24x earnings. As I’ve mentioned, before India is highly vulnerable to ripping oil prices. It’s also exposed to spiking food prices.

.

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.