They say patience is its own reward but when it comes to investors who display tenacity, resolve, conviction, or just plain stubbornness, it’s nice to get a bit of a monetary remuneration from time to time. As far as the miners of precious metals are concerned, there’s been precious little of that lately…like for almost a year and a half.

Recent issues of the EVA PR section have been advising readers to exercise patience with this group and on Wednesday that advice was indeed rewarded. Both the senior and junior miners vaulted by around 7%, which would actually be a nice month, much less a single trading session. Our recent EVA PRs have pointed out that the miners were at least stabilizing which, this year, is no small feat. In fact, one could argue, as frequently-quoted-by-this-newsletter David Rosenberg has, that flat is the new up. But up 7% is a whole lot more fun than flat.

Of course, the question is whether this was a one-day flash in the pan or if it signifies the long-awaited turn in this once turbocharged sub-sector.* As you may recall, it had a spectacular 2020. Since then, though, it’s been like sledding uphill in Cascade Concrete, the affectionate name Northwesterners have for our typical west slope snow conditions. (In other words, champagne powder, it ain’t!).

Weighing heavily on the group has been stagnant metals prices. This has been made even more vexing by the correctly anticipated, at least by this newsletter, onset of high and rising inflation. A depressing factor has been fears of higher interest rates. Fascinatingly, these worries have been realized at the same time that the miners first quit going down and then have suddenly come to life.

It could be that Wednesday’s spike by the precious metals complex was related to escalating fears of Vladimir Putin doing what Adolf Hitler did 81 years ago this June, except in the other direction, by invading Ukraine. However, Russian stocks soared on Wednesday, too, so this doesn’t seem like probable cause. (Or perhaps it was because President Biden said a little invasion might be acceptable to him; he might want to brush up on his Neville Chamberlain history.)

Stretching a bit more, maybe this sudden rally is due to something I’ve postulated in recent EVAs: An epiphany by a growing number of market participants that the Fed has no possible chance of achieving anything in the remote vicinity of restrictive monetary policy. Hard assets, like precious metals, thrive with negative yields--in other words, when interest rates run below inflation. That’s been happening in a big way for over a year, making the pathetic performance by all things related to gold and sliver even more frustrating. However, if there’s a spreading awareness that real interest rates are poised to stay negative as far as the eye can see—as I believe probable—that removes a heavy weight from the hard asset complex.

*Predictably, there has been about a 2% give-back by the gold miner ETF, GDX, since Wednesday’s Lazarus-like revival. However, it remains up 2.75% for the week when the S&P has fallen by roughly 3 ½%.

The strength of the US dollar—which is also odd when deeply negative real interest rates prevail—has been another drag on the miners since a rising dollar is almost always hard asset bearish. Now, though, the greenback is softening even as rates move up, another head-scratcher. This is possibly a further clue that markets are beginning to come to the conclusion the Fed can only go from the Big Easy to the Medium Easy.

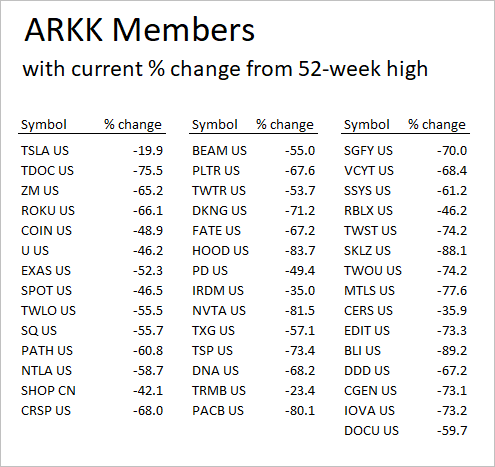

The continuing weakness in US equities would argue the other way. The once Crazy Over-Priced Stock (COPS) cohort, so often slammed in these pages, has been the primary casualty of fears that markets are facing their dreaded cold turkey moment. Since last fall, priced-beyond-perfection growth stocks have been increasingly discounting the time when the Fed is forced to stop supplying almost unlimited amounts of uppers, requiring equities to trade on fundamentals rather than hope and hype. While it might never actually achieve anything approaching tight money, its role as the always-obliging purveyor of monetary amphetamines is almost certainly coming to an end. For the COPS the mere threat of that has led to the kind of carnage shown below (courtesy of market maven par excellence, Kevin Muir):

By the way, the above isn’t to pick on Cathie Wood (the driving force behind the ARKK funds). As I’ve written in recent EVAs, the number of stocks being run through the slaughterhouse since last fall is extraordinary, particularly when combined with an S&P 500 that has, thus far, experienced a mild correction. Again, to me, this is a total flashback to the early days of the tech wreck in 2000. However, this bloodbath is happening at an even more accelerated rate.

As far as bonds go, which have been the source of a considerable amount of market weakness, my observation last week that there appeared to be a massive bid at 1.75% wasn’t too prescient. In fact, earlier this week, the 10-year treasury note yield blew through that like the German army going through the French lines in May of 1940 (staying with my WWII analogies). It hit nearly 1.9% before sliding back down to the former resistance point of 1.75%. That high had held since last spring but, now that it was decisively taken out, it becomes a support level, at least based on technical analysis.* Regardless of the technical interpretations, it’s my belief that long term yields are heading much higher, despite the reality the bond market is deeply oversold and may pause around here.

To close this EVA PR, it’s my hope that readers of my newsletter have heeded the recurring advice in these pages to have been avoiding and/or exiting the highly speculative parts of the financial markets over the past year. (Frankly, that’s been most of them.) In addition to the wipeout in the COPS, the crypto space is under severe downward pressure. Further, one of the most negatively rated styles for nearly a year in the EVA PR has been the Russell 2000 Growth Index. (Market segments such as Large Cap Value and Small Cap Growth are technically known as styles). It is now in full-blown bear market territory, down 25%.

It seems increasingly clear that there’s a lot of helium quickly coming out of the immense dirigible known as Bubble 3.0…at least by yours truly. On that note, we plan to begin publishing my book “Bubble 3.0” via Substack next week. Please be on alert for the official announcement.

On more special message is that as part of our EVA revamp, we will, for now, not be providing the Likes/Neutrals/Dislikes to non-Evergreen clients. If you are an Evergreen client and are not seeing it come through, please email Sydney Ford at sford@evergreengavekal.com. If you aren’t an Evergreen client and have valued this service, we’d like to hear from you, as well.

*Please note that treasury yields and prices move inversely; thus, when yields are rising, prices are falling.

Pursuant to the narrative section of our EVA PR, I believe it’s time to add more precious metal exposure to your portfolio. This assumes that you are not already too heavy in this space. If you are, you’ve definitely been marching to your own drummer, since almost all US investors have been entranced by tech stocks and nearly totally apathetic towards gold and silver. Moreover, for those looking for traditional precious metal-type inflation protection, many have opted for the crypto currencies, especially younger investors. However, the sudden taken-to-the-woodshed treatment of most US stocks has exposed a critical difference between precious metals (PMs) and cryptos. While the former have been behaving as excellent portfolio bulwarks, the latter are further vaporizing. Today’s violation of crucial support by even Bitcoin and Ethereum, the cream of the cryptos, is particularly ominous—and they were not exactly behaving in a Samson-like way before today’s thrashing. Should Vladmir Putin unleash his tanks, the odds are you’ll be pleased you added to your PM holdings, at least in that one way. For humanity overall, it will be a dark day. Obviously, I’d infinitely prefer gold and silver ripping higher due to the realization the Fed is trapped in a perma-easy mode than because of yet another war on the Eastern Front.

LIKE

NEUTRAL

Last week, I highlighted the importance of cash reserves during periods of market dislocations. (By the way, and per the above, the cryptos are vividly displaying why they don’t in any remote way qualify as cash equivalents.) For those who are cash-heavy right now, it’s reasonable to start deploying some of that. Those securities showing signs of resiliency during the adversity are a logical starting place.

As also noted in the narrative section of PR, the Russell 2000 Small Cap Growth Index is now in official bear market territory. Small Cap Growth has been one of this newsletter’s top picks-not-to-click. (Hat tip to Jim Grant on that phraseology.) While I wouldn’t advise buying this style yet, it’s time to become much less negative. In my personal account, I have closed out most of my short position in the IWO, the Small Cap Growth ETF.

DISLIKE

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.