“We’re going to become caretakers for robots. That’s what the next generation of work is going to be.”

-GRAY SCOTT, Futurist

INTRODUCTION

In early April, one of the “wise guy girl” talking heads released a video on the rise of robots where she claims that within a decade, we could be looking at dramatically different non-farm payroll data. In fact, she even quotes a Forrester study that suggests net-net, for every one job created, fifteen jobs will be lost.

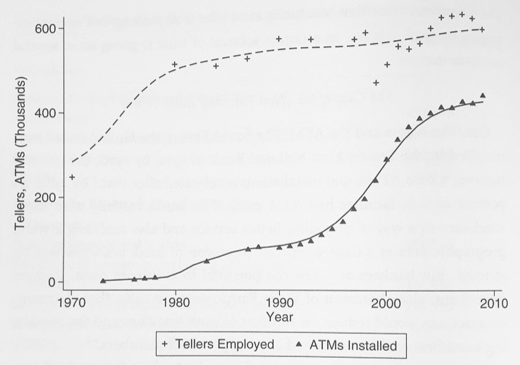

But automation alarmists tend to overlook one of the earliest instances of the robots vs. people debate. In the 1970s, the introduction of ATMs gave way to the theory that human tellers would eventually be obsolete, and that as more and more automated teller machines were introduced, fewer and fewer humans would have jobs in banking. However, that’s not what happened. As the chart below shows, even as the number of ATMs rose, so did the number of human tellers.

Source: Learning By Doing, by James Bessen

Source: Learning By Doing, by James Bessen

So, what happened? Why didn’t ATMs completely replace the need for people?

As James Bessen, economist and professor at Boston University points out in his book Learning by Doing: The Real Connection between Innovation, Wages and Wealth:

The average bank branch in an urban area required about 21 tellers. That was cut because of the ATM machine to about 13 tellers. But that meant it was cheaper to operate a branch. Well, banks wanted…to increase the number of branch offices. And when it became cheaper to do so, demand for branch offices increased. As a result, [overall] demand for bank tellers increased.

In this week’s Gavekal EVA, Dan Wang takes aim at several theories swirling around automation and its impact on jobs, the economy, and productivity. Similar to the study of ATMs and bank tellers, Dan provides evidence that fact does not always follow theory.

While we concede that robotics and automation are certainly hot areas that are picking up steam due to recent advancements in technology, the Robot Revolution reality has not sunk into the hardline macro-economic data… yet. Of course, this is subject to change, and automation alarmists could be correct. But taking a step back and assessing the impact of robotics and automation on the economy to date shows that the data is far less persuasive than the wise guy…err…girl… rhetoric.

Michael Johnston

Marketing and Communications Manager

To contact Michael, email:

mjohnston@evergreengavekal.com

ROBOTS EVERYWHERE, BUT THE STATISTICS

By Dan Wang

Four years ago, Louis wrote a book that opined on the disruptive economic effects of automation. He wasn’t the first to do this, but in 2013 the idea was not exactly mainstream. Today the threat of machines eating the jobs of middle class professionals from Pittsburgh to Paris looms large in political discourse and popular culture. Yet for all the agonizing about mechanized baristas in every neighborhood coffee shop, killer robots and subversive AI devices, the reality seems more prosaic. Focusing on the US, the aim of this piece is to ask whether the effects of enhanced computing and more responsive machines is yet showing up in macro-economic data. This can be done by considering five key metrics where smart machines and computers with basic artificial intelligence should make a difference.

More with less, in theory

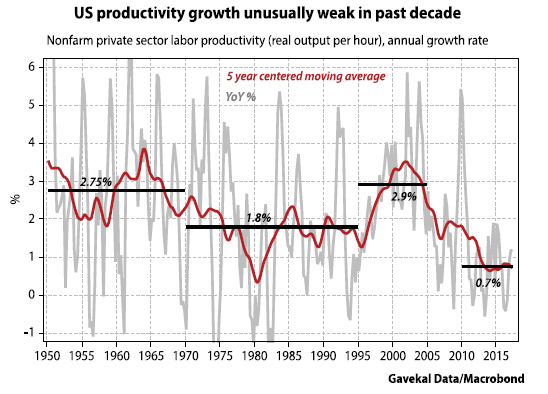

1. Higher productivity growth. Before kicking-off, keep in mind the basic equation for this holy grail measure of economic efficiency.

Productivity = output / unit of labor

The theory: It follows that replacing people with machines should boost productivity (imagine the proverbial supervisor watching over a football field’s worth of hard working robots). It also follows that mass-automation should go hand-in-hand with accelerating productivity growth. Getting more granular, this process can happen as new capital equipment allows workers to produce more output in their work day (the numerator boost), or alternatively, devices replace humans in the work place, so less labor is needed (the denominator reduction) to make the same output.

The reality: Between 1970 and 2004, US labor productivity grew by 2.1% a year. Since 2005, it has averaged 1.25%, and just 0.7% since 2010. To paraphrase US economist Robert Solow’s quip from the 1980s, you can see the automation age everywhere, but in the productivity statistics.

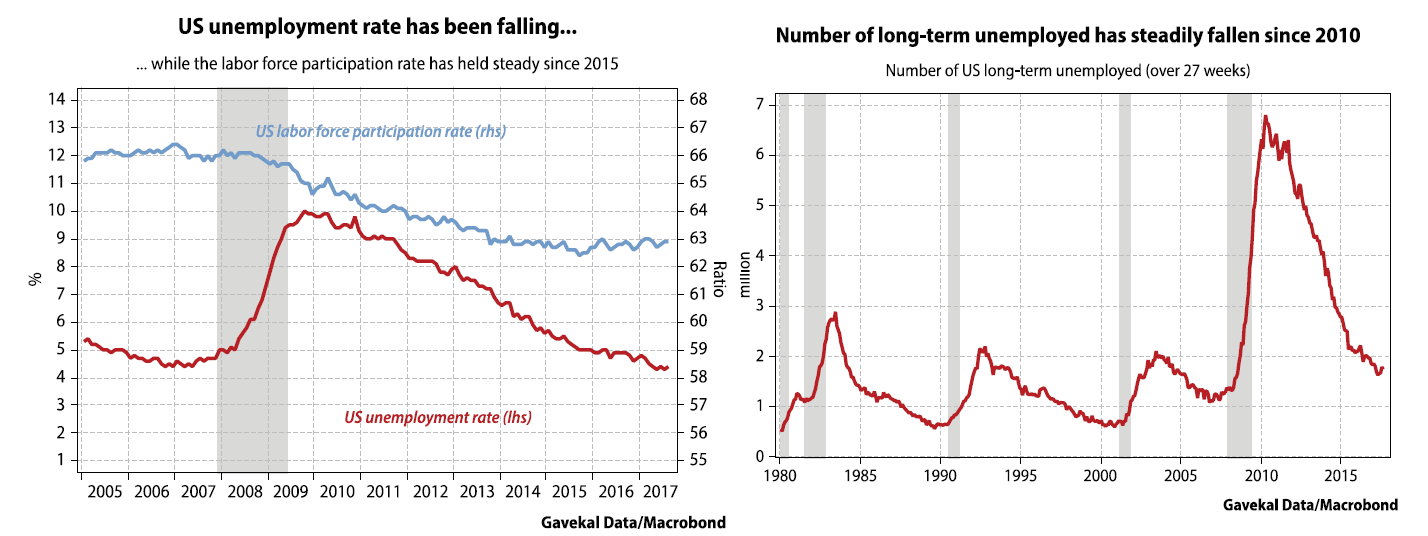

2. The theory: Rising unemployment and looser labor markets. If automation is replacing workers, the impact in those sectors should be to depress employment levels and labor force participation rates. This follows as the impact of firms replacing employees with software or robots is to make people unemployed. Such individuals can retrain and seek alternative employment, but that is a drawn out process, so the impact should be to push up the numbers of long-term unemployed.

The reality: The US unemployment rate of 4.4% is the lowest for 10 years. This situation stems from strong demand for labor rather than people dropping out of the workforce. While participation rates dropped sharply in the aftermath of the 2008-09 financial crisis, over the last two years they have stabilized. My colleagues Tan Kai Xian and Will Denyer currently characterize the US labor market as “very tight”.

The number of long-term unemployed folk spiked to unprecedented postwar levels in 2010, but has since declined sharply (see right hand chart above). While the number remains high for non-recessionary times, it’s in the range of previous historical cycles. The takeaway is that cyclical, rather than structural, factors were responsible for the spike.

By virtue of being a high-tech powerhouse and facing a purportedly rigid labor market, Japan is often cited as being at the leading edge of mass automation. Yet while Japan may make and use lots of robots, they do not yet seem to be a macro phenomenon. Japan’s unemployment rate stands at a 22 year-low of 2.8% and the companies complain of labor shortages.

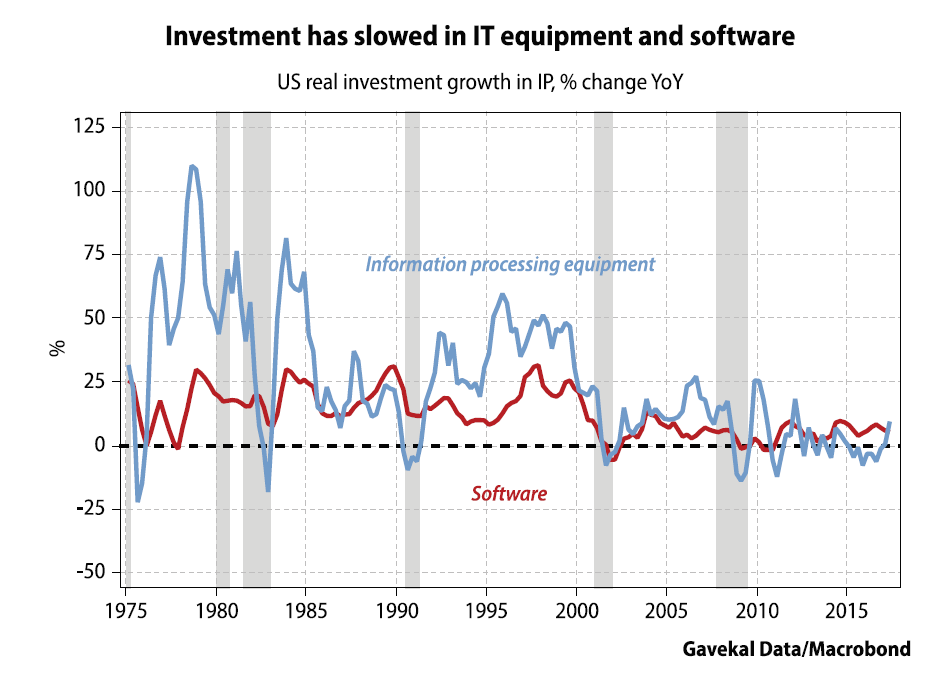

3. The theory: More technology spending. To augment or substitute labor, firms must first invest. This could mean buying new laptops, setting up an internet service, or installing robots to replace line workers.

The reality: US firms' investment in IT processing equipment and software, measured in real terms, has been slowing. A reduction in the structural economic growth rate may be dissuading firms from investing heavily in the large-scale automation of basic processes. Less clear is whether the true level of real capital expenditure is being captured. While price deflators are adjusted for quality differences, it is arguable whether these measures are understated.

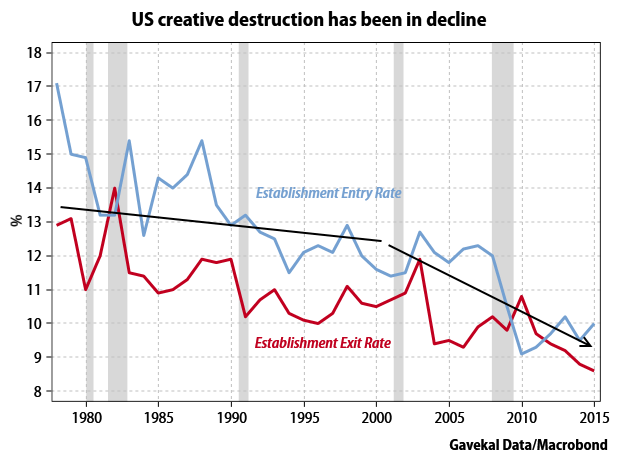

4. The theory: More creative destruction. The adoption of ever smarter machines should wipe out whole businesses and job categories. This process of renewal should see the emergence of new firms who are best able to capitalize on the new technologies.

The reality: Since the early 2000s, both the entry rate of new businesses and their exit rate have been in decline. Charles often attributes this phenomenon to negative real interest rates and the incentive they provide firms to engage in financially-engineered acquisitions rather than deploy capital in fresh ventures. What can be said with certainty is that this trend is not consistent with the transformative effect that genuine mass-automation would cause.

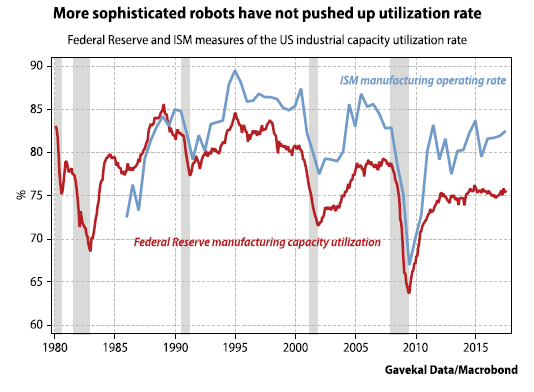

5. The theory: Higher industrial capacity utilization. Manufacturers in the US have consistently told survey takers that they can’t find skilled labor and this impedes them running at full capacity. As robots and industrial machinery get more sophisticated, manufacturers will come to rely less on such individuals and should be able to steadily increase output without incurring bottlenecks.

The reality: The two most commonly used measured of capacity utilization in the US tell a similar broad story. Factories in the US have not been able to push utilization from where it was five years ago, in part due to an absence of skilled labor. This difficulty in finding workers is clearly evident from surveys of employers. Smart machines have not ridden to their rescue.

Where are the robots?

Of course, shortly after Solow made his 1987 quip about the computer age not showing up in the productivity data, it did just that with a surge that lasted a decade. So, it is possible that automation is picking up speed but the macro-economic effects are lagged. Consider the following effects:

This piece does not aim to provide answers to the conundrum of weak productivity growth in most developed economies. It does make the simple observation that there is almost no evidence of radical economic effects stemming from large-scale automation.

OUR CURRENT LIKES AND DISLIKES

No changes this week.

LIKE

NEUTRAL

DISLIKE

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.