"It’s precisely when past investment returns look most glorious that future returns are likely to be the most dismal, and vice-versa."

-JOHN HUSSMAN

"Markets should be adjusting to massive support (of central banks) being in the rear-view mirror."

-MOHAMMED EL-ERIAN, chief economist at Allianz

"This is not an earnings-driven market, it is a momentum, liquidity, and multiple-driven market, pure and simple."

-Economist DAVID ROSENBERG

This week’s EVA is a continuation of last week’s “Pull It Together” issue (click here for access). The main idea is to summarize the key factors and forces Evergreen sees impacting the financial markets now and, more importantly, in the future.

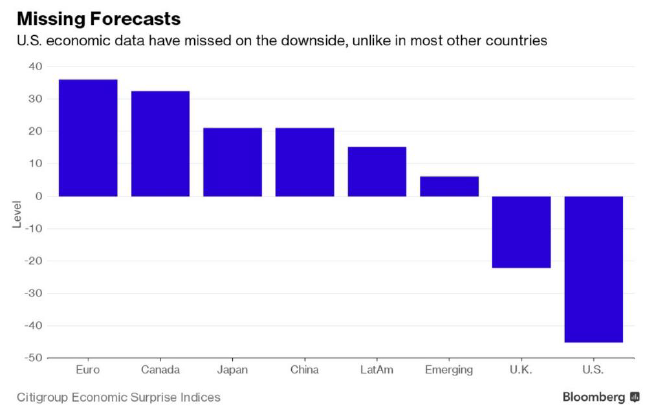

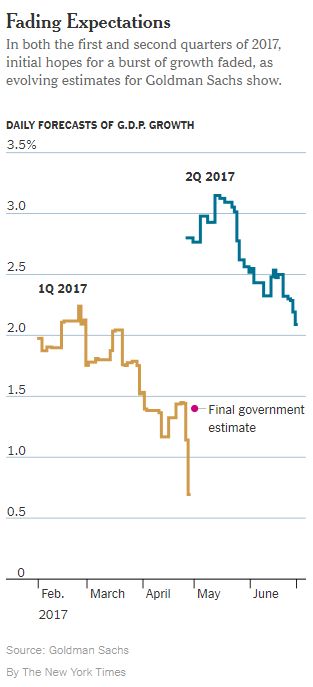

To begin, we look at the sudden shift that’s occurring in global bond markets. We also examine the trend of the US economy which, contrary to expectations at the start of the year, seems weaker than its developed country peers. (For now, instead of America first, it’s looking more like America last; if you think we’re exaggerating you might want to listen to JP Morgan CEO Jamie Dimon’s rant today, which has attracted enormous media attention.)

We also challenge the guru status of one of America’s most popular market commentators. As has happened at prior peaks, he and his network are once again encouraging investors to ignore extreme valuations and the darkening clouds on the US economy’s horizon. We believe it’s worth looking back at some of his earlier urgings to ignore past bubble warnings—and how misguided that advice turned out to be. Sadly, we see mounting evidence unsophisticated investors are being sucked in by the combination of steadily rising prices and media hype.

On the upbeat side, especially for those in need of income, we look at the opportunity created by the latest swoon in energy securities—at least until recently when they have defied the plethora of bears by rallying smartly. If you don’t care about 7% yields, with further recovery potential, feel free to skip that section!

(Note: Our usual summary can be found at the end of this two-part Pull It Together EVA.)

Bonds away? As noted last week, central banks around the world are shedding their dovish feathers. They have worn them for such a long time that stock market participants are naturally skeptical that there truly is a costume change underway. In the bond market, though, there doesn’t seem to be much doubt.

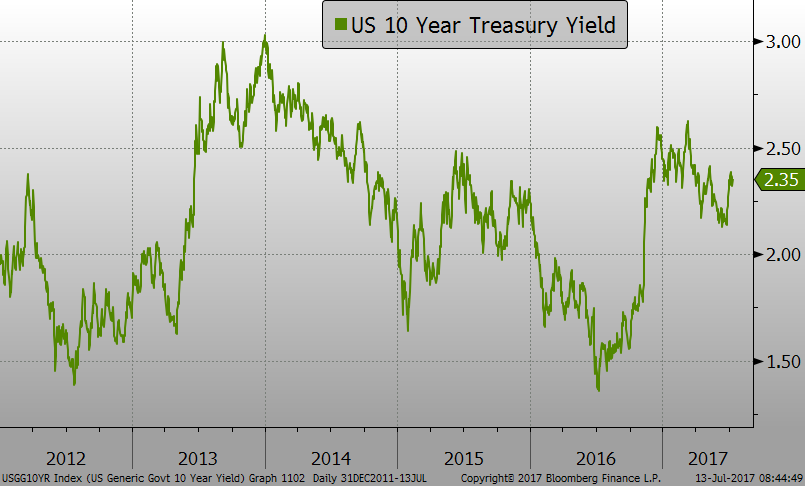

German bund yields have nearly tripled since mid-June, admittedly from the absurdly low level of ¼%. In the US, the rate rise has been more modest but it has still pushed rates up from a blip above 2.1% last month to nearly 2.4% earlier this week before backing off a bit. Interestingly, this bond sell-off occurred after speculative sentiment (read: the hedge fund community) became feverishly bullish on Treasury-notes last month. As often observed in these pages, when this “investment” contingent is heavily skewed on the optimistic side, it almost always pays to position in an opposite direction.*

In other words, the bond market was vulnerable to disappointing news. Almost simultaneously, it got a hefty dose. Besides the central bank rumblings from overseas about winding down ultra-accommodative policies, potentially joining the Fed in its new-found monetary sobriety, there was also a surprisingly robust Institute for Supply Management (ISM) release for both manufacturing and services (more to follow on that in the following section on the economy).

Bond commentators are now opining on the likelihood of the 10-year T-note yield rising to 2.6% or even 3%, the latter being where rates topped out in late December 2013, during the famous Taper Tantrum. In our view, that’s certainly possible, especially with so many speculators still “long and wrong”. But somewhere between 2.6% and 3%, we believe the negative impact will begin to bite, especially on crucial swaths of the economy such as autos and housing. As you may have read, both are cooling, especially the former. Further, the US retail industry appears to be in the throes of a full-blown bear market, courtesy of our local mega-disrupter, Amazon.

*By the way, speculative positioning was just as fiercely bearish on treasury notes back in March when yields were 2.6%, prior to a powerful rally.

It’s also probable that if we get up to those kind of yield levels, the typically trend-following hedge fund universe will be heavily short treasuries. Then, should the US economy look soggy once again, this will likely trigger a snappy bond rally.

If this seems too short-term oriented for your tastes, consider that every recession leads to materially lower bond yields. Currently, almost no one is worried about a downturn hitting our shores, even next year, despite how long in the choppers our present expansion is…which is why you should read the next section with an open and inquisitive mind.

Eerie echoes. Nearly 10 years ago, Evergreen went strongly against the prevailing consensus view by stating we felt a recession was likely in 2008. Despite our market valuation concerns in recent years, we have avoided making a repeat call (though we did come close in 2016, before the post-election confidence surge). In recent months, however, US economic data has once again softened. In fact, the so-called hard data—versus the soft, such as sentiment surveys—never did harden very much.

Earlier in the year, we were cautioning that there was far too much faith Trumponomics would trigger a boom. Our skepticism was based on the host of drags the US economy faced such as poor productivity, minimal labor force growth, excessive debt levels, and a mature, if not geriatric, expansion.

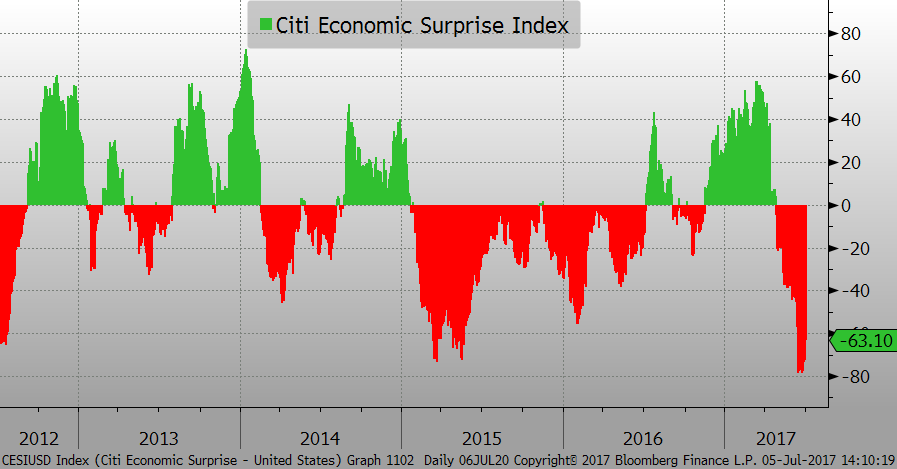

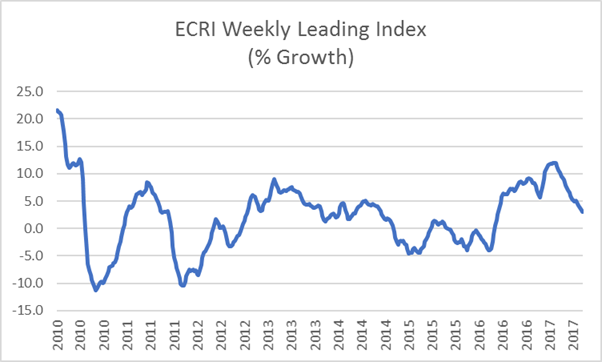

Since then, there has been a pronounced rolling over of key economic indicators such as the Citigroup Economic Surprise Index and the prestigious ECRI’s Leading Economic Indicators (ECRI called the last three recessions). And, as you may have noticed, the term “Trumponomics” has almost totally gone missing in the financial media.

Perhaps the most alarming factoid is that nominal GDP growth (total economic activity before subtracting inflation) is running at virtual recession levels. In the past, when the US economy was at this type of stall speed, the Fed was cutting rates. Instead, as we’ve noted in prior EVAs, we are on the verge of a double-tightening. (In fact, on Tuesday, one of the Fed’s doviest doves, Lyle Brainard, implied the Fed may start slimming its corpulent balance sheet this month, the other prong, along with rate hikes, of what is almost certain to be the first double-tightening in history.)

Bulls would argue that the very weakness of this expansion is in fact its essential strength as it has allowed for a much longer than normal up-phase. Undoubtedly, there is truth in this argument. However, the dark side of that thesis is that it also doesn’t take much deceleration to turn a limping recovery into an economic invalid.

Here are a few items you may want to consider in this regard:

No wonder Jamie Dimon was almost apoplectic on his call with analysts this morning! After all, what’s bad for America is bad for JP Jamie Morgan.

Of course, the data could perk up soon, as it did last year (though, again, that was mostly a function of soaring confidence vs. actual improvement in economic activity, as reflected in the paltry 1.2% Q1 GDP print). On that score, the aforementioned June ISM is encouraging. Further, the June jobs number was also upbeat, though wages were, once more, disappointing. Perhaps this is the start of an improving trend. But another survey, the Markit series—also tracking manufacturing and service activity—was released last week, as well. Paradoxically, it reported deterioration rather than improvement, and the Markit numbers have tended to be more accurate over the past six years. So which is right?

Time, as always, will tell, but the ISM numbers seem out of synch with the weight of economic evidence we’ve seen in recent months. We’re not yet ready to make a formal recession call but we are once again on high alert. However, if you’re looking for a “no worries, mate” view, there’s a certain TV channel that will never disappoint.

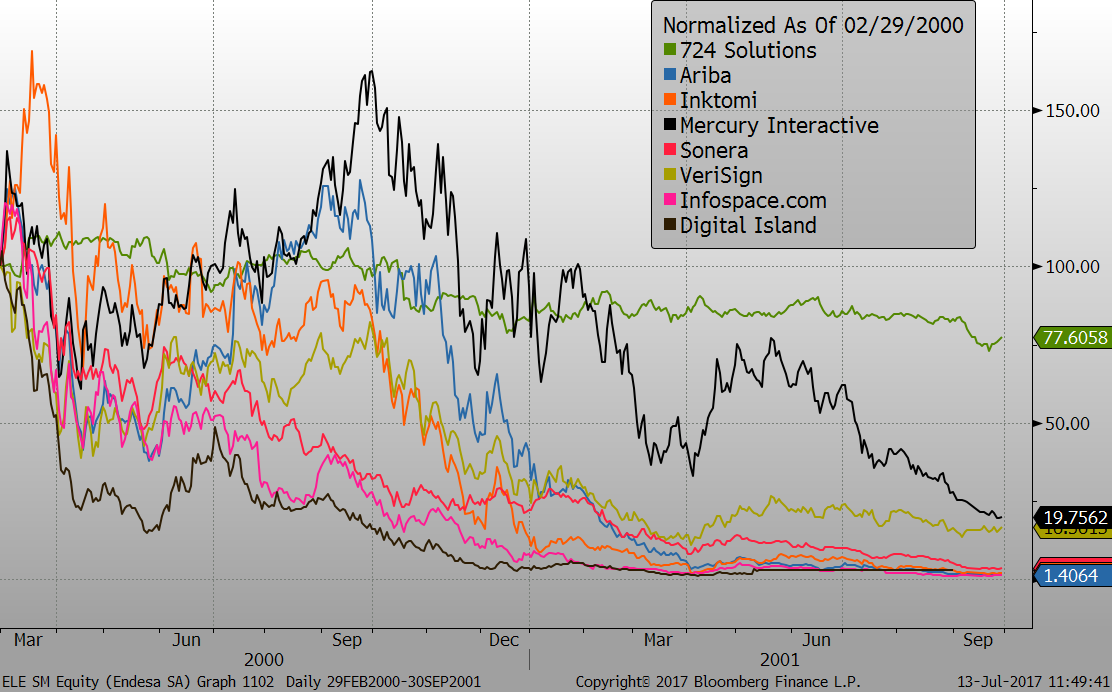

In CNBC We Trust. There are many similarities between the current bull market and those of the late 1990s and mid-2000s. One of them is the constant rooting on of stock prices by almost every regular on CNBC and the nearly as consistent disparaging of anyone who offers up a discouraging word. You can tell by their effusive verbiage and preening body language that they are loving this latest time in the bull-market twilight limelight. This is particularly true of that TV personality whose show is called—most appropriately—Mad Money. (Have you noticed how most of these talking heads look like they spend half of their waking hours in a tanning bed?) What they don’t tell you is that they and/or their network never saw the last two market blow-ups coming.

In fact, the Mad Money-meister himself gave a rousing speech in February of 2000 in which he exhorted his audience about 10 “must own” stocks. He went on to say that he hated the rest of the market which—since most investors then were piling into the type of stocks he adored—was actually attractively valued. You can see the subsequent performance of 9 out of 10 of this “elite” group below; to save you the work, the average percentage decline was roughly 90% over the next 19 months (we were unable to locate performance history on the 10th).

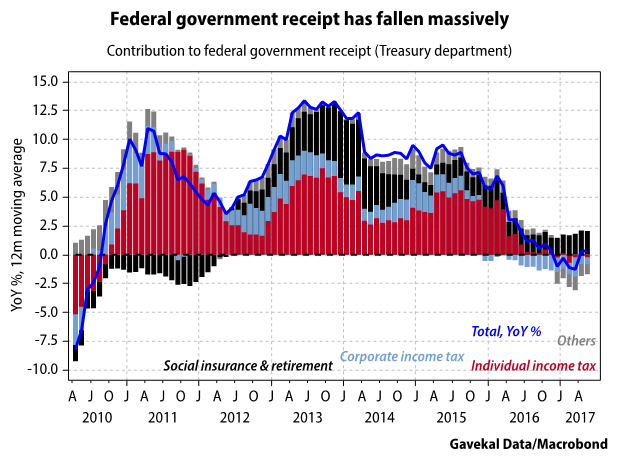

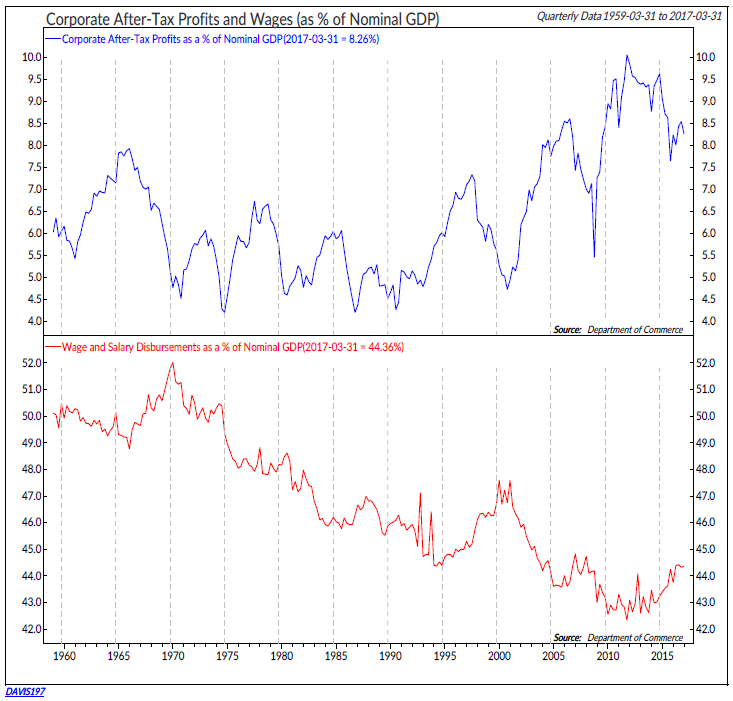

Another undiscussed topic on CNBC is that the corporate earnings surge they have been frothing about is, as discussed last week, highly questionable. David Rosenberg, Ned Davis, and Gavekal’s own Will Denyer have all quantified that overall corporate profits for both public and non-public companies actually fell in the first quarter.

Per David Rosenberg, Canada’s most famous economist, profits were actually down 7.3% in Q1 on an annualized and seasonally adjusted basis. This makes complete sense based on the trend in corporate tax receipts shown above.

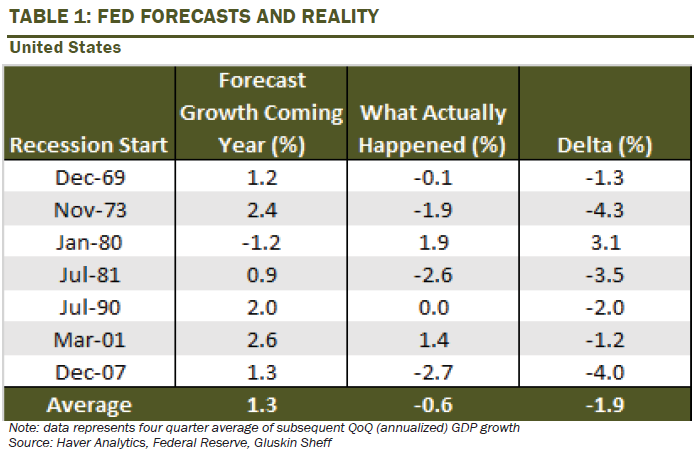

Fortunately, for those who want to believe this expansion is not facing The Grim Reaper’s unforgiving scythe, the Fed sees no recession on the horizon. But before you get too celebratory, please consider the following table, courtesy of David.

Not too encouraging, is it? But what about private economists? As he noted in his June 30th “Breakfast with Dave,” only 16% of economists in a recent Wall Street Journal survey anticipate a contraction. Again, this would be a source of solace, except that only 33% saw a recession back in late 2007—even after it had already started!

Maybe I’m just too old and cynical, but when I think that the US economy has grown by 1.3% a year in real terms over the past decade—equivalent to what it did during the Great Depression from 1929 to 1939—despite adding $10 trillion to our national debt, and the Fed’s $3.8 trillion of binge printing, I am appalled. As the new “King of Bonds”, Jeff Gundlach, has pointed out, if it weren’t for the government debt explosion, the growth would have only been 0.7% per annum. With no apologies whatsoever to Jim Cramer, that stinks! How does that kind of growth justify one of the most expensive markets in history?

It is not lost on me that in a long bull market—and since 1896 there is only one that has lasted longer—it’s irritating to focus on how weak the underlying fundamentals truly are. But reality is reality and it has a nasty habit of asserting itself…particularly once the investing public has become convinced the market is a perpetual profit-production machine.

My Joe Kennedy moment. Many of my so-called friends (some now of the former category) love to point out that I’ve been worried about “mad bull disease” for a very long time. Like all humans, I resent it very much when friends are right—especially at my expense! However, my rebuttal is to quote Winston Churchill when he warned a skeptical British parliament about the rising Nazi menace in the mid-1930s: Laugh but listen.

Along the listening lines, I’ve thought a lot lately about a series of recent conversations I had with a sweet woman working at our local grocery store (QFC, for Seattle area readers). When I am doing my usual back and forth commute between Seattle and Indian Wells, CA, during the winter (which lasts about eight months in our area, particularly this year), I go into QFC around 6:30 a.m. to buy the Wall Street Journal and Financial Times before they sell out.

Since the store is deserted at that early hour, we often get the chance to chat. Based on my reading material and attire, it’s obvious I’m in the financial business and a few months ago she started asking me what I thought about the stock market. No doubt it’s a shock to all EVA readers that I voiced my concerns to her. Though I didn’t precisely tell her that the US stock market is the second most expensive of the last 80 years, based on official (GAAP) earnings, I definitely warned her of its stretched-like-Spandex-on-a-Sumo-wrestler valuation.

At first, she didn’t respond much but as the market continued to rise, she has been enthusiastically regaling me with how much she has been making with the “conservative” fund in her IRA. When I asked her what that was, she told me it was—shock of all shocks—a Vanguard S&P 500 index fund.

As time went by, I discovered that she had sold her other funds to hold just this one since it was decisively outperforming the others. Further, my kindly checker had gotten her sister to fire her broker (who was “way too conservative”) and move all of her sis’s IRA assets into the same equity index fund. To say they have a lot of company is putting it mildly.

NET NEW CASH FLOW INTO DOMESTIC EQUITY INDEX FUNDS

Source: Felix Zuluaf, Ned Davis Research

Source: Felix Zuluaf, Ned Davis Research

Interestingly, my new friend is approaching retirement so her sister must be similarly vectoring. In other words, they are exactly the sort of folks who should be at most 50% exposed to stocks (probably less, actually). Yet they have been sucked into stocks by the 24/7 printing presses of the world’s central banks. This includes the once above-reproach Swiss National Bank (SNB) which has been fabricating money in order to buy stocks; the SNB is now one of the largest holders of US stocks, including $3 billion of the FAANGs (Facebook, Apple, Amazon, Netflix, Google).*

Back in the early 1970s—when human beings, unlike now, got caught up in fads—“one-decision” stocks were all the rage. This meant that a “wise” long-term investor simply bought IBM, Polaroid, Eastman Kodak, Xerox, et al, and that was that. Only one decision: just buy and never sell. It worked great for a year or two and then the bottom fell out, with most of them falling 60% or more. Some of these “buy and hold forever” names even went the way of all flesh, as in banko.

It’s my perception that many inherently risk-averse investors—and there are millions of them now heavily exposed to stocks— think the market is like a CD when it comes to past returns. They seem to believe that if they’ve made, say, 15% a year over the last six or seven years that’s effectively “in the bank”. But those of us who’ve been through a variety of cycles know how quickly Mr. Market can take back his prior largesse. There’s a lot of truth in the old saying that bear markets return wealth to its rightful owners—and that’s not those who don’t understand, or remember, how brutally painful those plunges can be.

The only way to truly lock in gains is to sell and move into cash before the bears come calling (at least with a hefty portion of your portfolio). But, admittedly, that is very hard to do when the market appears to have no downside. It’s also contrary to the second-coming of the “one-decision” and “only-buy-never-sell” market wisdom.

Market mythology holds that Joe Kennedy decided to go short before the 1929 crash because he began to get stock tips from his shoeshine boy. Of course, it goes without saying that buying index funds is a lot safer than buying individual stocks. Unless, perhaps, when almost everyone else is buying them, too.

*Please see important disclosure following the piece.

Master Limited Pariahs. What everyone most definitely isn’t buying these days are Master Limited Partnerships, more popularly (or unpopularly) known as MLPs. After a rousing recovery in 2016—following an excruciating 60% plunge from mid-2014 to early last year—MLPs experienced a sudden 18% haircut in recent months.

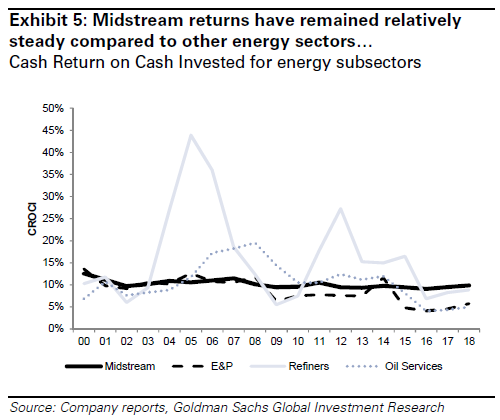

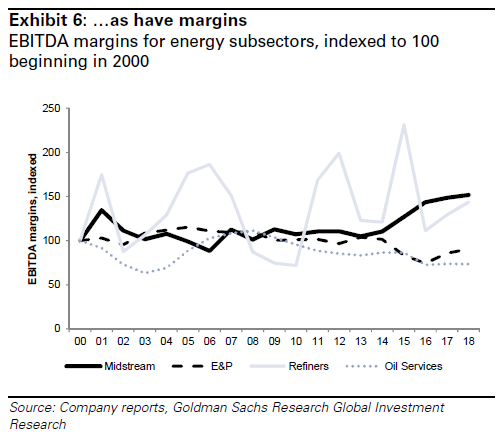

The cause, as usual, was weaker oil prices. The logic, also as usual, was highly flawed. Per the below chart, you can see that MLPs have far less sensitivity to oil prices than do other energy sectors. Moreover, as is also on display, their yields are immensely higher than other equity income vehicles.

As energy prices have fallen—a development we warned was probable earlier this year—the boo-birds have come out of the woodwork, also something we were convinced would happen. One oft-quoted—and, just as often, off-the-mark—pundit even opined that oil was a worthless commodity. (By the way, this same “expert” had said back in early 2016 that oil would not rise to $44 in his lifetime; a year later, it was trading for $55, so he must have thought he was terminally ill back then). It’s interesting that oil has snapped back smartly since he uttered those words (Zero Hedge reported yesterday he has now covered his short).

For sure, the recent price decline in the midstream (pipeline, storage terminals, logistics, etc.) MLPs wasn’t as horrific as in 2015. But the fact that they remain down much more from the 2014 energy peak than integrated oil companies like Chevron and Exxon, which have considerable exposure to lower prices, makes no sense. Unlike two years ago, US production is rising, not falling. This means more volume for the MLPs to process. Thus, what’s bad for oil and gas prices is good for MLPs.

Even more so than with oil, America’s gas cup runneth over. Since the typical MLP is more gas than oil exposed, this is additional excellent news for this re-maligned asset class. As usual, Evergreen has been buying into the sell-off, once more capturing yields as high as 11%.* Also as usual, it was a painful experience…until recently when, out of the blue, they rallied 7.88%, out-performing the 6.11% snap back by oil itself. Frankly, this tight correlation is just as silly on the upside as it was on the downside, but we’ll take it.

The above yield comparison with REITs is particularly noteworthy. During the 2008/2009 mega-panic, nearly every REIT cut, eliminated, or resorted to paying its dividend in stock. Meanwhile, MLPs collectively increased their payouts, as you can see below. Even during the energy nuclear winter of 2015/2016, MLPs hiked their distributions, in aggregate. Typically, MLPs and REITs have fairly similar yields. Obviously, right now, the gap is truly gaping. Something tells me this gap is going to get filled, either by MLP yields coming down or REIT yields rising…or perhaps a combination of both.

*Please see important disclosure following the piece.

Later this summer, cash-heavy investors—the few that are left—are likely to have an opportunity to buy more than “on sale” MLPs. The problem is, according to extensive work by Ned Davis Research, cash levels among households are near the lowest levels ever, even as stock holdings are close to record highs. Obviously, most US investors have turned a Van Gogh ear to Warren Buffett’s recurring advice to be fearful when others are greedy.

Let’s close with a quick review of this two-part Pull It Together EVA.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

OUR CURRENT LIKES AND DISLIKES

No changes this week.

LIKE

NEUTRAL

DISLIKE

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.